If you're considering taking a personal loan to cover your expenses while waiting on a disability decision, make sure you know the pros and cons.

If you can't work because of a medical condition and you're waiting for Social Security to decide your disability claim, you might be running out of money. It could take months—even years—for your Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) application to work its way through the disability claims process. (Find out why your decision might be taking so long.)

How do you get by until your disability benefits start? You might consider getting a personal loan to tide you over. And sometimes there are loans available—but you should think carefully before you agree to take on new debt when there's no guarantee Social Security will approve your disability application. When making your decision, it's important to be aware of both the upsides and the downsides in getting a personal loan.

- What Loans Are Available for Disabled Individuals?

- Personal Loans While Waiting on Disability

- Pros and Cons of Getting a Disability Loan

- Loans to Avoid While Waiting for SSDI or SSI Disability

- Social Security Disability Loans

- Get Help From Your State While You Wait for SSI

- How to Get a Loan While Waiting on Disability

- Getting Legal Help For Your Disability Claim

What Loans Are Available for Disabled Individuals?

Some private providers may be able to offer you a loan while you wait for Social Security to decide your disability claim or after you've been awarded but before your benefits have started to kick in. The availability of these loans depends on several factors, including whether you have collateral you could use to secure a loan (as in a home equity line of credit), your credit rating, whether you've applied for SSDI or SSI, and what state you live in.

Personal Loans While Waiting on Disability

You might be able to get a personal loan to help you pay your bills while you wait for Social Security to approve your disability application. There are a couple of possible sources.

Since disability loans are generally personal loans, it's usually easier to get them from finance offices—also called consumer loan offices—than from traditional lending institutions like banks. Most consumer loan companies are more lenient when evaluating your prior history of installment loans (think car loans) and revolving debt (like credit card payments).

Credit unions are another potential source of personal loans while you wait for SSDI or SSI disability. And because they're member-owned, they might not require you to have the same excellent credit a bank would require you to have.

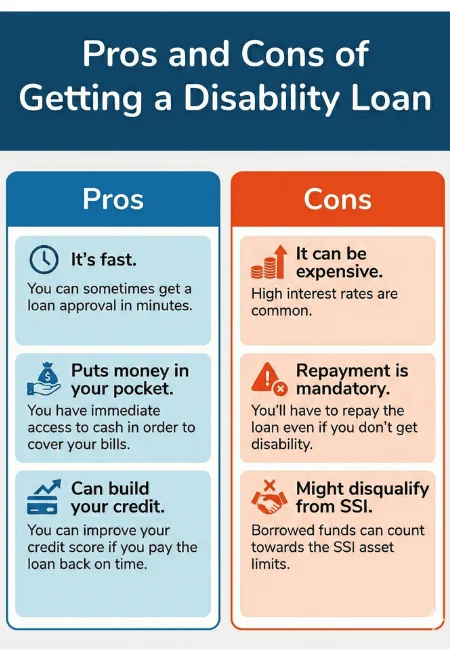

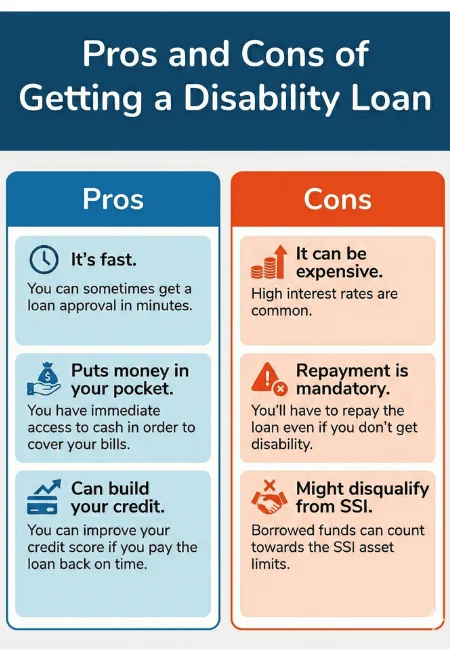

Pros and Cons of Getting a Disability Loan

There are some advantages and disadvantages to getting a personal loan while you wait for your Social Security determination.

Pros of Getting a Loan While Waiting for Disability

When you can't work and you have no income because of a disability, you still need to eat and pay your bills while you wait for Social Security to decide your claim. A personal loan can help get you through.

It's fast. Getting a decision on a personal loan to cover your expenses while you wait for disability can be very quick. You can sometimes get approved within minutes of applying.

It puts money in your pocket. If you can secure a personal loan, you'll have immediate cash on hand to cover your expenses while you wait for your disability to come through.

It can build your credit. If you can manage the cost and repayment terms of a personal loan, you can actually improve your credit.

Cons of Getting a Loan When You Don't Know If You'll Be Approved

One of the most obvious downsides to using personal loans to cover your expenses while waiting on disability is the cost.

It can be expensive. Before taking out a personal loan, you need to consider that these loans can come with high interest rates, especially if you're not working when you get one.

You'll have to repay it even if your disability is denied. You might be able to keep the amount of interest you'll pay fairly small if you can repay the loan quickly using your Social Security disability backpay. But without that award, the interest payments could balloon. And if your disability is denied, you might not be able to pay the loan back on time, if at all.

It might disqualify you from SSI. If you do get a loan and you applied for SSI disability, you'll need to be careful not to go over SSI's asset limit. Any funds that you borrow and don't spend in the same month will count toward your SSI asset limit ($2,000 for an individual and $3,000 for a couple).

Loans to Avoid While Waiting for SSDI or SSI Disability

There are some types of loans you should stay away from. Getting a personal loan online is generally not a good idea. Personal loans that you get online often have annual percentage rates (APR) over 30%, and that's in addition to origination and document fees.

Payday loans have even higher interest rates when you look at the APR. Payday loan APRs are typically 400% to 500%. (Compare this to a credit card's APR, which might be around 20%.) Most people who take out a payday loan can't pay the loan back right away and end up getting another payday loan within 30 days of the first. The interest that adds up can make it impossible to pay back a payday loan.

With a pawnshop loan, you're less likely to get trapped in an endless cycle of debt, but the fees can be high compared to the amount of money you get. Typical APRs for pawnshop loans can be 100% to 250%.

Social Security Disability Loans

If you're applying for SSI disability benefits, you might qualify for an emergency loan from the Social Security Administration. (20 C.F.R. § 416.520)(2026). To get a one-time emergency loan, it must be likely that you'll qualify for SSI's presumptive disability program, which pays you benefits for up to six months while you wait for Social Security to process your initial SSI claim.

But to get the emergency benefits, you'll need to prove that you have an extreme hardship (such as a lack of shelter or food). And the emergency advance payment is a loan—you must pay it back with your presumptive disability benefits from SSI.

Get Help From Your State While You Wait for SSI

You also might be able to get a loan through the Interim Assistance Reimbursement (IAR) program if you live in a state that participates in the program (more than half do) and you're likely to qualify for SSI. IAR loans are a type of public assistance designed to help people waiting for SSI disability benefits. To get an IAR loan, you'll have to sign an agreement promising that you'll pay back the assistance with your SSI money.

How to Get a Loan While Waiting on Disability

Getting a loan can be difficult during the best of times. But convincing a lender to give you a loan when you're disabled and can't work can be extremely challenging. There are a few strategies you should keep in mind when considering and applying for loans to get through the long wait for Social Security disability.

- Check with your state's social services department (sometimes called the Department of Human Services) to see if your state offers financial assistance or special loans for people waiting for a Social Security determination.

- Be sure you're getting the best loan rates you can. Although disability loans (personal loans) generally carry higher interest and fees than collateral loans (like a mortgage), there's competition between lenders, so shop around.

- Wait to apply for a loan until you need it. Many personal loans are short-term, and you don't want yours to come due before Social Security decides your claim.

A loan isn't your only option to cover your expenses until you get your SSDI or SSI disability benefits. Learn about other financial help you might get while waiting for disability.

Getting Legal Help For Your Disability Claim

Although finding enough money to pay for an attorney is likely the last thing on your mind if you're thinking about getting a disability loan, hiring an experienced disability lawyer can be an excellent investment. That's because disability lawyers work on contingency, meaning they don't get paid unless (and until) you win your claim. Furthermore, representatives' fees are paid directly by Social Security out of any past due benefits you're owed, so there's minimal, if any, upfront costs for you in exchange for a potentially large reward.

Hiring a lawyer is usually worth it because having one improves your chances of winning your disability claim. Your attorney can gather the medical evidence you'll need in order to show that you're disabled, keep on top of appeal deadlines, and advocate on your behalf at a disability hearing. Most disability attorneys offer free consultations, so there's little risk in asking around to find a lawyer who's a good match for your needs.

- What Loans Are Available for Disabled Individuals?

- Personal Loans While Waiting on Disability

- Pros and Cons of Getting a Disability Loan

- Loans to Avoid While Waiting for SSDI or SSI Disability

- Social Security Disability Loans

- Get Help From Your State While You Wait for SSI

- How to Get a Loan While Waiting on Disability

- Getting Legal Help For Your Disability Claim