Learn when osteoarthritis in the joints, knees, or spine becomes severe enough to be considered a disability.

Osteoarthritis—the most common type of arthritis—occurs when the cartilage that covers the ends of your bones wears down. This deterioration can cause pain and stiffness in the joints, swelling, muscle weakness, and a reduced range of motion in the affected joints. Osteoarthritis can occur in any joint but is most often found in the hands, hips, knees, or spine.

Symptoms from osteoarthritis can vary wildly in severity. Somebody with mild osteoarthritis who has "bad knees" may feel a dull throbbing during humid days (when moisture in the air causes the joint tissue to swell) but otherwise gets around without issue, while somebody with severe osteoarthritis may have stabbing pain in their knees that limits how long they can walk. Likewise, osteoarthritis may cause a mild sacroiliac (SI) joint dysfunction that can be managed with a lower back pillow, while severe SI joint dysfunction may require surgical intervention.

- At What Stage Is Osteoarthritis a Disability?

- How You Can Get SSDI or SSI for Osteoarthritis Under a Disability Listing

- Qualifying for Disability Based on Osteoarthritis Work Restrictions

- Medical Evidence Required to Prove Disability Due to Osteoarthritis

- How Hard Is It to Get Disability for Osteoarthritis?

- Can I Get a Living Allowance for Osteoarthritis?

- How to File for SSDI or SSI

- Getting Legal Help With Your Disability Claim

At What Stage Is Osteoarthritis a Disability?

Social Security awards benefits to people who have a medically determinable impairment that prevents them from working full-time for at least one year. So if you've been diagnosed with osteoarthritis or joint pain and you're still earning at or above the level of substantial gainful activity, you won't yet qualify for disability benefits.

Because osteoarthritis is often associated with aging, there may come a time when you're no longer able to do many job duties as a result of your joint pain. Osteoarthritis in the cervical spine (neck) or lumbar spine (lower back) can make it difficult to perform basic work functions such as sitting at a desk, lifting boxes, or picking up dropped objects. When osteoarthritis occurs in your hands, you can struggle with fine motor movements like typing or pressing buttons.

If your osteoarthritis has progressed to the point where you have significant functional limitations that keep you from working at all, you'll likely qualify for disability benefits from Social Security.

How You Can Get SSDI or SSI for Osteoarthritis Under a Disability Listing

First, you'll need to establish preliminary eligibility for one of the two disability benefit programs offered by the Social Security Administration. Social Security Disability Insurance (SSDI) is available to people who've earned enough work credits over the years to establish coverage under the program. Supplemental Security Income (SSI) is a needs-based benefit, so you'll need to have limited income and assets to qualify. If you aren't eligible for either SSDI or SSI, you won't be able to collect disability benefits, no matter how serious your osteoarthritis is.

Assuming that you're legally allowed to receive SSDI or SSI, your first chance to get benefits—Step 3 in the Social Security five-step disability determination process—is by meeting the requirements of a listed impairment. Listed impairments are conditions that Social Security considers especially severe. If you have a medical condition on the "listing of impairments" and you can document certain specific functional limitations or test results, you will automatically qualify for benefits without having to show that you can't work at all.

Osteoarthritis isn't one of the listed impairments, but because it can affect multiple joints in different ways, you may be able to meet one of the related listings for the musculoskeletal system.

Meeting Listings 1.15 or 1.16 With Osteoarthritis in the Lumbar Spine

It's fairly common for osteoarthritis to occur in the facet joints in between the bones of the spine, but that will qualify for disability benefits only under certain conditions. You may be able to meet the requirements of one of the listings for spinal disorders mentioned below if you have osteoarthritis in your lumbar spine that affects your nerves to a significant degree.

- Listing 1.15, Disorders of the skeletal spine resulting in compromise of a nerve root, for osteoarthritis that causes your bones to put pressure on nerves in your spine and makes it extremely difficult to walk, use your hands, or a combination of both.

- Listing 1.16, Lumbar spinal stenosis resulting in compromise of the cauda equina, for osteoarthritis in the lower lumbar spine that presses on a bundle of nerves called the cauda equina and makes it extremely difficult to walk, use your hands, or both.

To meet these listings, you'll need to have evidence of physical examinations and objective tests showing that your osteoarthritis is causing functional abnormalities as a result of nerve pressure. You can find more in-depth information on these listing requirements in our articles on getting disability for nerve root damage and spinal stenosis.

Meeting Listings 1.17 or 1.18 With Major Joint Pain or Tricompartmental Osteoarthritis

If you have osteoarthritis in a major joint—meaning your hips, knees, ankles, shoulders, elbows, wrists, or hands—you might meet one of the listings for joint impairments. Similar to the listings for spinal disorders, you can only qualify for benefits if you can show that you're significantly limited in your ability to walk or use your hands.

- Listing 1.17, Reconstructive surgery or surgical arthrodesis of a major weight-bearing joint, for osteoarthritis treated by surgical reconstruction or fusion of the affected joint resulting in the need for a bilateral ambulatory aid such as a wheelchair.

- Listing 1.18, Abnormality of a major joint in any extremity, for osteoarthritis resulting in greatly reduced motion in the affected joint that makes it extremely difficult to walk, use your hands, or both.

As with the spinal condition listings, you'll need to have objective medical evidence establishing that something is wrong with the affected joint. Knee replacements are a common procedure for people with tricompartmental osteoarthritis (which affects all three parts of the knee) that may qualify under listing 1.17, while people who have hand osteoarthritis may be able to meet the requirements of listing 1.18.

In some cases, Social Security may find that even though your symptoms don't exactly match the requirements of a listed impairment, your condition is basically the same as a listing in terms of medical severity and duration. It's typically rare to qualify for SSDI or SSI by "equaling a listing," but you may have a shot at getting benefits this way if you have favorable testimony from a medical expert at a disability hearing.

Qualifying for Disability Based on Osteoarthritis Work Restrictions

If you have osteoarthritis or joint pain but don't meet the criteria under any of the listings discussed above, you can still qualify for disability benefits if you have so many work restrictions that you couldn't reasonably be expected to perform a full-time job. To determine whether you're able to work, Social Security will assess your residual functional capacity, or RFC. Your RFC is a statement about the kind of activities you're still capable of doing despite your osteoarthritis.

What's In Your RFC?

Social Security reviews your medical records and activities of daily living for information about your functional limitations. The agency then translates those limitations into work restrictions, which are included in your RFC. Here are some examples of what a typical RFC might contain for a disability applicant with osteoarthritis in different areas:

- People with lower extremity osteoarthritis in their hip, knee, or ankle may struggle to be on their feet long enough to carry out basic chores such as grocery shopping, even if they don't need an assistive device. Their RFC will likely contain restrictions on how many total hours they're able to stand and walk in a workday.

- People with upper extremity osteoarthritis in their shoulder, elbow, wrist, or hand may struggle to lift even small items or have difficulty reaching and typing. Their RFC will likely contain restrictions on how much weight they are able to lift and carry during the work day, as well as limitations on how long they use their arms and hands to carry out tasks involving fine and gross motor movements.

- People with lumbar osteoarthritis who have lower back pain will likely have restrictions on how long they can stand or sit in one place. Their RFC may include a limitation to sit-down jobs, jobs that allow them to switch positions at will, or a need for work that will let them elevate their legs to relieve pain.

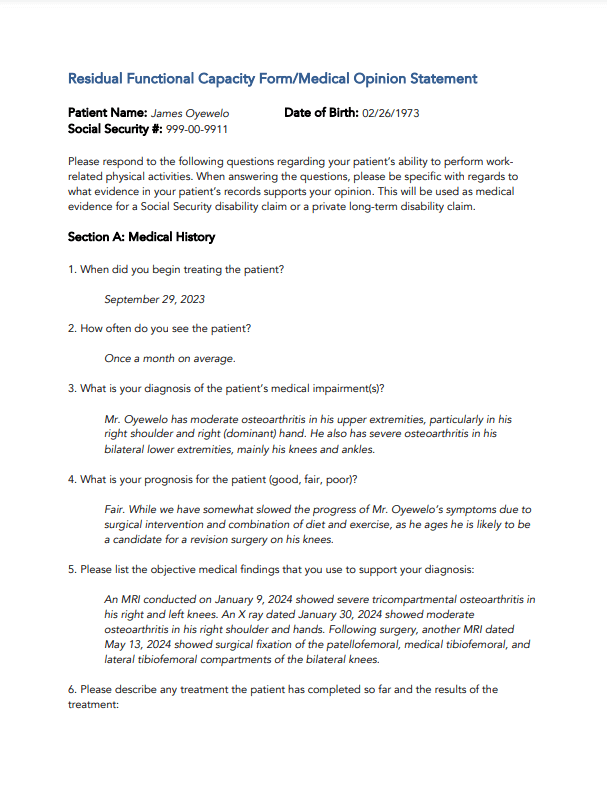

Any functional limitation that's documented in your medical records should be included in your RFC. Social Security also must consider how your combined impairments have an impact on your ability to work (including obesity), so if you have additional physical or mental conditions that affect your functioning, let the agency know. You can also ask your doctor to complete an RFC form laying out your limitations in detail. Click on the thumbnail below for an example of a helpful medical opinion for an osteoarthritis claim.

How Does Social Security Use Your RFC?

Social Security compares your RFC with the demands of your past relevant work to see whether you could still do those jobs today. For example, if your old job was as a construction worker but your current RFC limits you to sedentary (sit-down) work, Social Security won't expect you to return to the construction job given your current limitations.

If you can't do your past work, the agency then proceeds to the fifth and final step in the sequential evaluation process—determining whether you should get a medical-vocational allowance. A "medical-vocational allowance" means that Social Security has decided that, given your age, education, skill set, and RFC, no jobs exist in the national economy that you could reasonably be expected to perform.

For people under the age of 50, this generally means being unable to perform the simplest, least physically demanding jobs. Applicants 50 years of age and older may qualify for benefits even if they can perform less strenuous work using a special set of rules called "the grid." Social Security uses the grid to find people disabled who are nearing full retirement age when the agency doesn't expect them to learn a new line of work.

Medical Evidence Required to Prove Disability Due to Osteoarthritis

The main way that Social Security evaluates your claim is based on your medical evidence. This includes doctors' notes, X-rays or MRIs, hospital records, and laboratory tests. Specifically, for claims involving osteoarthritis, the agency will look for:

- physical exam reports with detailed descriptions of orthopedic or neurologic problems

- treatment notes with reports of your subjective symptoms, such as the frequency and severity of your pain

- prescriptions for an assistive device, such as a cane or walker

- imaging and diagnostic tests showing evidence of physical abnormalities

- operative reports for any surgical procedures, and

- history of any treatments tried—including medications and their side effects—and what the results of the treatments were.

Social Security will also take into consideration any doctor's opinions, such as a medical source statement from your regular physician or the report from an independent consultative examiner.

How Hard Is It to Get Disability for Osteoarthritis?

Even if your osteoarthritis causes you to have difficulty walking or using your hands, Social Security will still probably deny your initial application. Social Security only awards about 38% of applications at the initial level. However, you can improve your chances of getting approved on appeal by following these tips:

- Get on the same page as your doctor. It's important to have open and honest discussions with your doctor about your symptoms and limitations. Social Security will compare your doctor's treatment notes with what you claim on your application to see if they match.

- Comply with your treatment plan. Social Security wants to see that you're doing everything you can to improve your condition. If you don't follow your doctor's recommendations or take your medications as prescribed, Social Security has a reason to deny you, because you could get better.

- Include other medical conditions. It's not uncommon for people with osteoarthritis, or any other condition causing chronic pain, to also experience depression or anxiety. Social Security has to consider how all of your impairments affect your ability to work when evaluating your claim, so it's important to list all of the serious conditions you experience on your application, even if you'd rather not admit to them.

If you receive a denial letter and your osteoarthritis has worsened—or you think Social Security missed a crucial piece of evidence in their evaluation— consider contacting a disability lawyer to help you with your appeal.

Can I Get a Living Allowance for Osteoarthritis?

Social Security doesn't pay benefits based on the kind of disabling condition you have—if you qualify for disability you'll receive the same amount for osteoarthritis as you would for any other disorder. Instead, your monthly check depends on the type of benefit program you qualify for. SSDI amounts are calculated from your earnings history, while SSI payments consist of a flat monthly rate minus any countable income you have for that month.

For 2025, the maximum amount you can receive in SSDI is $4,018 per month (up from $3,822 in 2024), but the average payment is much lower, around $1,600. That's because SSDI is based on individual wage history, which varies greatly between beneficiaries. SSI payments are based on the federal benefit rate, which in 2025 is $967 per month (up from $943 in 2024). Some states have additional cash supplements for SSI recipients, but they are often modest amounts.

How to File for SSDI or SSI

You can apply for Social Security disability online using the agency's web portal, in person at your local field office, or by calling 800-772-1213 (TTY 800-325-0778) from 8 a.m. to 7 p.m., Monday through Friday. When you apply, you'll need to provide the contact information and dates of treatment for all of your medical providers, the dates of any medical tests, and the names, addresses, and dates of employment for all of your employers in the last five years.

After you submit your application, Social Security sends your file to your state's Disability Determination Services (DDS) office. Next, a claims examiner will request and review your medical records and may call you for an interview or send you additional paperwork. When the claims examiner has enough information, Social Security will make the decision and notify you by mail. This normally takes three to four months, but it could take longer.

Getting Legal Help With Your Disability Claim

You aren't required to have a representative at any stage of the disability determination process, but it's usually a smart thing to do. Social Security is more likely to approve a disability claim when the claimant is represented by an advocate or attorney. From the initial application all the way up to a hearing in front of an administrative law judge, your representative will know how to present your case in the most favorable light.

If you have questions or you'd like help with your application, consider contacting an experienced disability lawyer or advocate, who may be willing to give you a free case evaluation. Working with a disability attorney can help you get the evidence you need to convince the Social Security Administration that you qualify for benefits.

- At What Stage Is Osteoarthritis a Disability?

- How You Can Get SSDI or SSI for Osteoarthritis Under a Disability Listing

- Qualifying for Disability Based on Osteoarthritis Work Restrictions

- Medical Evidence Required to Prove Disability Due to Osteoarthritis

- How Hard Is It to Get Disability for Osteoarthritis?

- Can I Get a Living Allowance for Osteoarthritis?

- How to File for SSDI or SSI

- Getting Legal Help With Your Disability Claim