Learn what types of long- and short-term disability insurance are available to residents of the Garden State.

If you live in New Jersey and have a medical condition that keeps you from working full-time, you can apply for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) benefits. These federal benefits are available to people of any state who become unable to engage in substantial gainful activity for at least one year. According to the most recent data from the Social Security Administration, about 3.4% of adults in New Jersey receive SSDI, the program for people who've earned enough in work credits to qualify, and 1.8% receive SSI, a needs-based program that has a resource cap on eligibility.

While Social Security's definition of disability is the same regardless of where you live, states process their own initial applications and approval ratings often differ between them. Additionally, the state of New Jersey has a program of temporary disability insurance for residents who will only be off work for a short time. Knowing how to navigate the disability process at the state level and beyond can help increase your chances of qualifying for benefits.

- How to Apply for Social Security Disability in New Jersey

- What Conditions Qualify for Disability in NJ?

- How Hard Is It to Get on Disability in New Jersey?

- Appealing Disability Denials in NJ

- How Long Does It Take to Get a Disability Hearing in New Jersey?

- How Much Does New Jersey Pay in SSDI Every Month?

- How Much Is the Monthly SSI Payment in New Jersey?

- Does NJ Tax Social Security Disability Benefits?

- NJ Vocational Rehabilitation and Veterans' Benefits

- Should I Get a NJ Disability Lawyer?

How to Apply for Social Security Disability in New Jersey

Applications for SSDI or SSI benefits are filed in the same way. You'll need to complete Form SSA-16, which you can submit electronically, over the phone, or in person. Here's how:

- Apply online at ssa.gov. Filing online has many benefits, such as giving you the option to save your application and return to it later. You'll also receive a confirmation number where you can track your application.

- Call Social Security's national number at 800-772-1213 from 8:00 a.m. to 7:00 p.m., Monday through Friday, to speak with a representative. If you're deaf or hard of hearing, you can use the TTY number at 800-325-0778.

- File in person at your local Social Security field office. You can use the locator toolhere to find the office closest to you.

You can apply for both SSDI and SSI at the same time, but you must be financially eligible for at least one of the programs in order to receive benefits. SSDI eligibility is based on your earnings history and how much you've paid into the program by way of payroll taxes, while SSI eligibility is determined by having income and assets below a certain low threshold.

For more comprehensive details, including what personal information you should have on hand when you apply, check out our article on filing a disability claim with Social Security.

What Conditions Qualify for Disability in NJ?

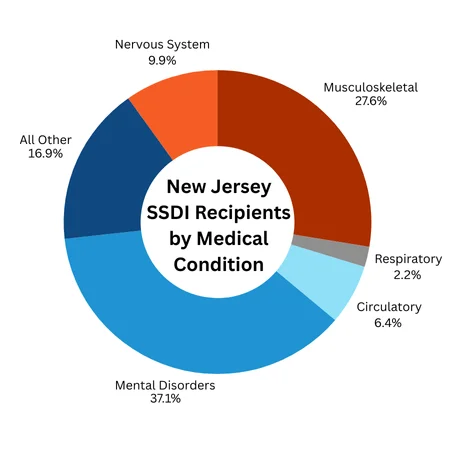

Any severe impairment may qualify you for disability benefits, provided that you have enough medical evidence to show that you either meet a listing or are unable to work at any job. In New Jersey, some of the most commonly awarded impairments are mental illnesses (such as anxiety or depression), musculoskeletal conditions (like back pain), and nervous system disorders (for example, diabetic neuropathy).

The chart below illustrates the percentage of SSDI recipients in New Jersey who were found disabled based on the most commonly awarded medical conditions.

Source: Annual Statistical Report on the Social Security Disability Insurance Program, 2023

For more information, check out our article on what conditions qualify for Social Security disability benefits.

How Hard Is It to Get on Disability in New Jersey?

After you've taken the initial step of handing in your application, Social Security will make sure that you meet the technical qualifications for receiving benefits. Your file is then passed on to New Jersey's Disability Determination Services, or "DDS," the state agency tasked with processing disability claims in NJ. There, a claims examiner—with help from a medical consultant—reviews your records and decides whether you're disabled.

Individually, your chances are higher the stronger your medical records are. Statistically speaking, however, 38.4% of disability claims in New Jersey were approved at the initial application stage—about the same as the national average of 38%—and 13.8% were approved following reconsideration review (slightly below the national rate of 15.9%).

Keep in mind that most claimants in New Jersey aren't awarded benefits until after they've had a hearing with an administrative law judge (ALJ). As of the fiscal year ending July 2025, ALJs in hearing offices serving New Jersey issued 6,736 decisions on disability claims. 4,363 of those decisions resulted in either fully or partially favorable outcomes, resulting in an approval rate of about 64%.

Appealing Disability Denials in NJ

As you can see from the above statistics, disability applicants in New Jersey have their best odds of winning their claims at the hearing level. So if you aren't awarded benefits at the initial determination stage you'll need to appeal, probably twice, before you get to speak to a judge.

You have 60 days after you've received a denial letter to submit your appeal. Your first appeal is called reconsideration, and it means that another claims examiner at DDS will review your file to see whether the initial denial was correct. Most people aren't approved at reconsideration, so you'll likely need to appeal further by requesting a disability hearing (again within 60 days after the reconsideration denial).

When you request a hearing, your case is sent from New Jersey DDS to Social Security's Office of Hearings Operations (OHO). Your hearing will be conducted by a judge at one of the OHOs that serve New Jersey residents:

Jersey City OHO

Second Floor

325 West Side Avenue

Jersey City, NJ 07305

Phone: (877) 773-7451

Fax: (833) 721-0877

The Jersey City OHO handles claims from the Clifton, Hackensack, Hoboken, Jersey City and Paterson field offices.

Newark OHO

3rd Floor

1100 Raymond Boulevard

Newark, NJ 07102

Phone: (877) 405-9798

Fax: (833) 779-0460

The Newark OHO handles claims from the East Orange, Neptune, New Brunswick, Newark, Newton, Parsippany, Somerville, Springfield Ave, Trenton, Union Township, and Woodbridge field offices.

South Jersey OHO

2475 McClellan Avenue

Pennsauken, NJ 08109

Phone: (866) 964-5769

Fax: (833) 942-2183

The South Jersey OHO handles claims from the Brick, Bridgeton, Cherry Hill, Egg Harbor Township, Glassboro, Mount Holly, Rio Grande, and Toms River field offices.

How Long Does It Take to Get a Disability Hearing in New Jersey?

As of July 2025, the average wait time for a hearing in each of these OHOs is as follows:

- Jersey City OHO: 8 months from the date of the hearing request

- Newark OHO: 8 months from the date of the hearing request

- South Jersey OHO: 9 months from the date of the hearing request

You can help shorten the waiting time by submitting your request for a hearing as soon as possible after you get your second denial letter. While you have 60 days to appeal, if you wait until the last minute, you're effectively tacking on two months that could be spent at OHO scheduling.

If you receive an unfavorable decision following your hearing, you can appeal yet again to Social Security's Appeals Council and if that doesn't work, you can take your disability claim to the United States District Court for the State of New Jersey.

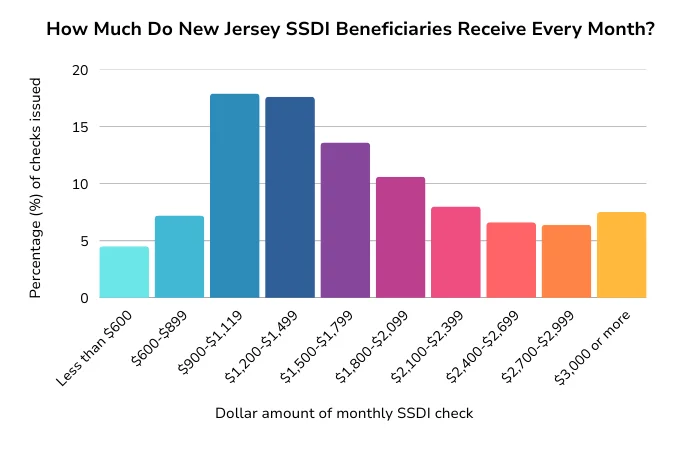

How Much Does New Jersey Pay in SSDI Every Month?

Because SSDI and SSI are federal benefits, the amount you'll receive doesn't change from state to state. SSDI payments are particularly tailored to each beneficiary since they're calculated based on your individual earnings record, which can vary significantly between each person. The chart below shows the distribution of SSDI payments for beneficiaries in New Jersey:

Source: Annual Statistical Report on the Social Security Disability Insurance Program, 2023

How Much Is the Monthly SSI Payment in New Jersey?

SSI is a federal program for low-income disabled individuals that pays out a specific monthly amount to all who qualify. As of 2025, the maximum federal monthly payment for individuals who have no other income is $967 ($1,450 for couples). But the average payment is usually lower, because Social Security subtracts income and the value of free rent and food from the payment.

New Jersey provides a modest additional state supplement to the federal SSI benefit. The exact amount depends on your living situation. The chart below shows the monthly maximum total combined federal and NJ state SSI amounts for 2025. Keep in mind that your payment may be lower if you have other countable income.

|

Category |

2025 Total Monthly Payment |

|

Individual living alone or with others in the household |

$988.25 |

|

Individual living with a spouse who isn't eligible for SSI |

$1,119.99 |

|

Individual living in someone else's household who is receiving support and maintenance |

$688.98 |

|

Individual living in a licensed residential health care facility |

$1,177.05 |

|

Individual living in a public hospital or Medicaid-approved long-term health facility |

$50.00 |

|

Couple living alone or with others in the household |

$1,475.35 |

|

Couple living in someone else's household who are receiving support and maintenance |

$1,059.75 |

|

Couple living in a licensed residential health care facility |

$2,188.35 |

Does NJ Tax Social Security Disability Benefits?

No, New Jersey does not levy a state tax on "all payments received under the Federal Social Security Act," which includes ongoing monthly benefits as well as any lump sum payments such as backpay. (NJ Rev Stat § 54A:6-2 (2024)). Benefits received under the state temporary disability insurance program are likewise exempt from NJ state taxes, although you may have to pay federal income tax on the amount. (N.J. Admin. Code § 18:35-2.3)).

NJ Vocational Rehabilitation and Veterans' Benefits

Some disabled people can benefit from programs that provide a pathway to employment. New Jersey provides these programs through the Division of Vocational Rehabilitation Services. Disabled residents can search through a selection of career counseling, skill development, and job placement services that can help them return to full-time work or find part-time employment that suits their needs. The division also offers financial assistance and money planning for people who are receiving SSDI or SSI.

Veterans who have a service-connected medical condition can get a disability rating from the VA. While many veterans are aware of the VA benefits they're entitled to, fewer might know about additional benefits provided by the state of New Jersey. These benefits can include reduced or free entry to state parks, hiring incentives for employers of veterans, and property tax credits for disabled vets. To learn more, visit the New Jersey Department of Veterans & Military Affairs.

Should I Get a NJ Disability Lawyer?

You aren't obligated to hire an attorney at any stage of the disability determination process, but it's often a good idea, especially if you've already been denied benefits. Consider contacting a lawyer for a free initial consultation to see if your case is strong enough to base an appeal on and find out what you need to do to strengthen your case. Your chances of winning an appeal are much higher if you're represented by a lawyer or advocate with experience in Social Security disability. Disability lawyers typically work on contingency—meaning they don't get paid unless you win your case—so there's little upfront risk in hiring one.

- How to Apply for Social Security Disability in New Jersey

- What Conditions Qualify for Disability in NJ?

- How Hard Is It to Get on Disability in New Jersey?

- Appealing Disability Denials in NJ

- How Long Does It Take to Get a Disability Hearing in New Jersey?

- How Much Does New Jersey Pay in SSDI Every Month?

- How Much Is the Monthly SSI Payment in New Jersey?

- Does NJ Tax Social Security Disability Benefits?

- NJ Vocational Rehabilitation and Veterans’ Benefits

- Should I Get a NJ Disability Lawyer?