Disability payments come from Social Security, but the State of Missouri pays a supplement to SSI recipients who live in residential care or assisted living facilities.

If you live in Missouri and you're unable to work full-time for at least a year due to a medical condition, you may be thinking about applying for disability benefits. According to the most recent available Social Security data, 5.2% of adults in Missouri receive Social Security Disability Insurance (SSDI) and 2% receive Supplemental Security Income (SSI). Veterans with service-connected impairments may also be eligible for compensation from the VA.

Both the Social Security Administration (SSA) and the VA are federal agencies, so the legal requirements don't vary from state to state. However, when you file for Social Security benefits in Missouri, your application is first reviewed by a state agency that makes the initial determination as to whether you qualify for disability. Knowing how to navigate the disability process at the state level and beyond goes a long way towards making a successful claim.

- How to Apply for Disability in Missouri

- What Disability Program Should I Apply For?

- What Conditions Qualify for Disability in Missouri?

- What Are My Chances of Getting Disability in Missouri?

- How to Appeal a Disability Denial in Missouri

- How Much is Disability in Missouri?

- Benefits for Missouri Veterans

- Vocational Rehabilitation Services

- How Can I Get Help Applying for Social Security Disability in Missouri?

How to Apply for Disability in Missouri

Submitting your application for SSDI or SSI benefits is fairly straightforward. You'll start by completing Form SSA-16, which you can complete electronically, over the phone, or in person. (You can learn more in our article about filing a disability claim with Social Security.) Below you can find the contact information for your preferred method of filing.

- Apply online at ssa.gov. Filing online has many benefits, such as giving you the option to save your application and return to it later. You'll also receive a confirmation number where you can track your application.

- Call Social Security's national number at 800-772-1213 from 8:00 a.m. to 7:00 p.m., Monday through Friday, to speak with a representative. If you're deaf or hard of hearing, you can use the TTY number at 800-325-0778.

- File in person at your local Social Security field office. You can use the locator tool here to find the office closest to you.

After you've taken the initial step of handing in your application, Social Security will make sure that you meet the technical qualifications for receiving benefits. Your file is then passed on to Missouri Disability Determination Services, or "DDS," the state agency tasked with processing disability claims in Missouri. There, a claims examiner—with help from a medical consultant—reviews your records and decides whether you're disabled.

You can communicate with the DDS serving your area to submit additional medical records, provide any missing information requested by the agency, or to check on your case status. Contact information for the six DDS offices in Missouri is provided below.

|

Central Office

|

Cape Girardeau

|

|

Jefferson City

|

Kansas City

|

|

Springfield

|

St. Louis Phone: (314) 416-2803 or (877) 878-4644 |

Applying for VA benefits works in a similar manner. You can apply online, over the phone, or at your local VA field office. For more comprehensive information, check out our article on filing for veterans' disability benefits.

What Disability Program Should I Apply For?

SSDI and SSI are the two disability programs—also referred to as Title II and Title XVI—administered by Social Security. While the agency's definition of disability is the same for both programs, each benefit has its own preliminary eligibility criteria that you must satisfy in order to legally receive payment.

For SSDI, this means having enough work credits to be insured under the program on the date you became disabled. (Work credits are earned by paying into the program through payroll or self-employment taxes.) SSI, on the other hand, is a needs-based benefit available to people with limited income and resources, regardless of work history.

You can file for both programs and let Social Security figure out which ones you qualify for, but you must be financially eligible to receive at least one of the two benefits. If you're "overresourced" for SSI and you don't have enough work credits to get SSDI, you can't receive any benefits no matter how severe your disabling symptoms are.

Even if you don't meet the technical criteria to receive SSDI or SSI, that doesn't mean that you're out of options. While Missouri doesn't have a public short-term disability program—most states don't—you may have a private short- or long-term disability insurance provider that can provide benefits for up to two years if you're unable to perform your own or any other occupation.

What Conditions Qualify for Disability in Missouri?

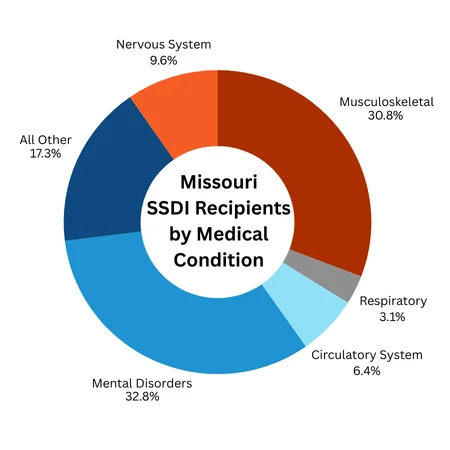

Any severe impairment may qualify you for disability benefits, provided that you have enough medical evidence to show that you either meet a listing or are unable to work at any job. In Missouri, some of the most commonly awarded impairments are mental illnesses (such as anxiety or depression), musculoskeletal conditions (like back pain), and nervous system disorders (for example, diabetic neuropathy).

The chart below illustrates the percentage of SSDI recipients in Missouri who were found disabled based on the most commonly awarded medical conditions.

Source: Annual Statistical Report on the Social Security Disability Insurance Program, 2023

For more information, check out our article on what conditions qualify for Social Security disability benefits.

What Are My Chances of Getting Disability in Missouri?

Individually, your chances are higher the stronger your medical records are. Statistically speaking, however, about 43% of disability claims in Missouri were approved at the initial application stage—slightly greater than the national average of 38%—and about 15% were approved following reconsideration review (about the same as the national rate).

Most claimants in Missouri aren't awarded benefits until after they've had a hearing with an administrative law judge (ALJ). As of the fiscal year ending July 2025, ALJs in hearing offices across Missouri issued 7,633 decisions on disability claims. 4,043 of those decisions resulted in either fully or partially favorable outcomes, resulting in an approval rate of about 53%.

How to Appeal a Disability Denial in Missouri

As you can see from the above statistics, disability claimants in Missouri have a better-than-average chance of getting their application approved on their first try, but their best odds are still at the hearing level. That means that if you're not awarded benefits at the initial determination stage, you'll need to appeal, probably twice, before you get to speak to a judge.

You have 60 days after you've received a denial letter to submit your appeal. Your first appeal is called reconsideration, and it means that another claims examiner at DDS will review your file to see whether the initial denial was correct. Most people aren't approved at reconsideration, so you'll likely need to appeal further by requesting a disability hearing (again within 60 days after the reconsideration denial).

When you request a hearing, your case is sent from the Missouri DDS to Social Security's Office of Hearings Operations (OHO). Your hearing will be conducted by a judge at one of the OHOs that serve Missouri residents:

Columbia HO (handles claims from the Columbia, Jefferson City, Moberly, and Sedalia field offices)

3402 Buttonwood Dr

Columbia, Missouri 65201

Phone: (877) 331-8351

Fax: (833) 721-0879

Kansas City HO (handles claims from the Chillicothe, Gladstone, Independence, Kansas City, Maryville, and St. Joseph field offices)

Suite 910

2300 Main

Kansas City, MO 64108-2450

Telephone: (888) 488-7742

Fax: (833) 311-0098

Springfield HO (handles claims from the Joplin, Lebanon, Nevada, Springfield, and West Plains field offices)

2143 E Primrose Street, Suite C

Springfield, Missouri 65804

Phone: (888) 472-2404

Fax: (833) 748-0025

St. Louis HO (handles claims from the Cape Girardeau, Hannibal, Kennett, Kirksville, Park Hills, Poplar Bluff, Rolla, Sikeston, and St. Louis field offices)

Robert A. Young Federal Building

1222 Spruce Street, Room 6.106

St. Louis, MO 63103-9923

Telephone: (866) 404-1859

Fax: (833) 311-0096

As of July 2025, the average wait time for a hearing in each of these OHOs is 7 months. If you receive an unfavorable decision following your hearing, you can appeal yet again to Social Security's Appeals Council and if that doesn't work, you can take your disability claim to the Eastern or Western Federal District Courts for the state of Missouri.

How Much is Disability in Missouri?

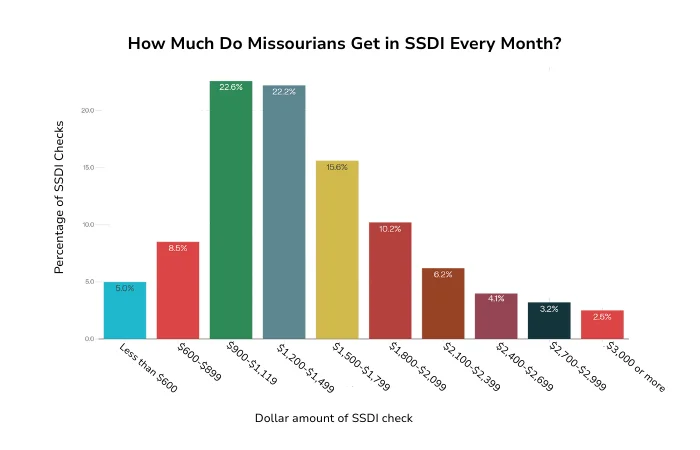

Because SSDI and SSI are federal benefits, the amount you'll receive doesn't change from state to state. SSDI payments are particularly tailored to each beneficiary since they're calculated based on your individual earnings record, which can vary significantly between each person. SSI payments are set annually by the federal government at a flat monthly rate that's decreased if you have additional income.

According to Social Security, the average monthly SSDI payment made to Missouri residents is $1,493.95. The chart below shows the distribution of SSDI checks to Missourians, with most falling within the range of $900-$1800 per month.

Source: Annual Statistical Report on the Social Security Disability Insurance Program, 2023

Missouri doesn't tax Social Security benefits for disability recipients who have an adjusted gross income of less than $85,000 ($100,000 for married couples). Above that, Missouri will tax a portion of the benefits. Similarly, the federal government will tax a portion of SSDI benefits for people with higher incomes. But neither the IRS nor the state of Missouri will tax SSI benefits.

Many states provide supplemental payments for people who receive SSI or Medicaid, a related healthcare program that SSI beneficiaries are often eligible for. Missouri residents who qualify for SSI or Medicaid may also receive a modest additional payment if they live in a nursing home or other assisted living facility. You can learn more about this benefit at the Missouri Department of Social Services website.

Benefits for Missouri Veterans

Veterans who have a medical condition that was caused by or got worse from their time on active duty can get a disability rating from the VA. (Your rating is a major factor in determining how much you can receive in monthly disability compensation.) While many veterans are aware of the VA benefits they're entitled to, fewer might know about additional benefits provided by the state of Missouri. These benefits can include state tax exemptions for retirement pensions, hiring incentives for employers of veterans, and reduced recreational permits for disabled vets. To learn more, visit the webpage of the Missouri Veterans' Commission.

Vocational Rehabilitation Services

If you're disabled but want to attempt a return to work, the Missouri Division of Vocational Rehabilitation (VR) can help. The agency can help prepare you for a job, find a job, and provide training for a job. When you contact your local VR office, representatives will ask you questions to determine whether you're eligible for services and what services you can receive. To help with the assessment, you should bring a copy of your SSI or SSDI award letter to prove you're currently receiving disability benefits.

How Can I Get Help Applying for Social Security Disability in Missouri?

If you're denied disability benefits, you should contact a lawyer for a free initial consultation to see if your case is strong enough to base an appeal on and find out what you need to do to strengthen your case. Your chances of winning an appeal are much higher if you're represented by a lawyer or advocate with experience in Social Security disability. Disability lawyers typically work on contingency—meaning they don't get paid unless you win your case—so there's little upfront risk in hiring one.

- How to Apply for Disability in Missouri

- What Disability Program Should I Apply For?

- What Conditions Qualify for Disability in Missouri?

- What Are My Chances of Getting Disability in Missouri?

- How to Appeal a Disability Denial in Missouri

- How Much is Disability in Missouri?

- Benefits for Missouri Veterans

- Vocational Rehabilitation Services

- How Can I Get Help Applying for Social Security Disability in Missouri?