If your treatment for breast cancer keeps you from working for at least one year, you may qualify for SSDI or SSI.

Breast cancer is one of the most commonly diagnosed cancers in the United States. The National Cancer Institute estimates that for 2025, about 316,000 estimated new breast cancer cases are diagnosed in women and 2,800 cases in men. While breast cancer has a high rate of remission (meaning signs and symptoms of the cancer go away) when diagnosed early, side effects from treatment can last for a long time.

The Social Security Administration (SSA) recognizes that treatment for breast cancer can take a large toll on the body and the mind. If you've been out of work for at least one year after receiving a diagnosis of breast cancer—or you've just started treatment and aren't sure when you'll return to work—you should be aware of your options when it comes to disability benefits.

How Can You Get Disability Benefits for Breast Cancer?

The SSA awards disability benefits to people who have a medically determinable impairment that prevents them from engaging in substantial gainful activity for at least twelve months. Depending on the extent of your breast cancer and whether it has metastasized—spread to other parts of your body—you can establish that you're disabled in one of the following ways:

- by qualifying under the Compassionate Allowances program

- by meeting or equaling a listed impairment, or

- by showing that you can't work under a medical-vocational allowance.

Before the agency can determine whether you're medically disabled, however, you'll need to satisfy the non-medical requirements for either the Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) benefit programs. SSDI eligibility is based on your employment and wage history, while SSI is needs-based and available to people with limited income and assets. If you satisfy these preliminary criteria, Social Security will review your medical records for evidence of test results or functional limitations that may be disabling.

Provide Medical Records of Breast Cancer Diagnosis and Treatment

When reviewing your records, Social Security will first be on the lookout for a diagnosis of breast cancer based on imaging (such as an MRI or PET scan), mammograms, and biopsies. Then, the agency will want to see what treatment options your doctor has recommended, such as chemotherapy, radiation therapy, hormone therapy, lumpectomy, and mastectomy. Lastly, because these treatments can cause serious side effects and extended recovery periods, the SSA will want to see how they're affecting your ability to perform your activities of daily living.

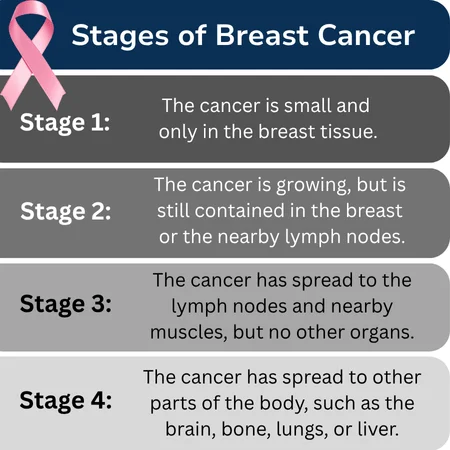

Oncologists (cancer doctors) classify breast cancer according to stages. The stages reflect how far along your cancer diagnosis is. The chart below illustrates the staging criteria:

The higher your cancer stage is (4 is the highest), the more likely it is that you'll be awarded disability benefits earlier. For example, if you have stage 4 breast cancer, you can qualify under the Compassionate Allowances list and have your application processed quickly so that you can receive benefits faster.

Meeting or Equaling the Disability Listing for Breast Cancer

If you have an earlier stage of breast cancer, such as stage 2 or stage 3, you might qualify for disability based on Social Security's "listing" for breast cancer. Listed impairments are medical conditions that aren't quite urgent enough to warrant a quick compassionate allowance, but are still serious enough to be considered automatically disabling.

Breast cancer is one of the listed impairments. To determine whether you're disabled according to listing13.10 for breast cancer, the SSA will look at your medical record for evidence of at least one of the following:

- locally advanced cancer (breast cancer that has extended to the chest, skin, or deeper into the breast)

- carcinoma (a type of cancer that starts in skin or organ cells) that has spread to lymph nodes or other organs

- carcinoma that comes back after treatment

- small-cell (oat-cell) carcinoma, or

- secondary lymphedema (a complication from breast cancer treatment).

You can show your oncologist the breast cancer listing and ask your doctor's opinion as to whether your cancer meets any of the above criteria.

Getting Disability for Breast Cancer Under a Medical-Vocational Allowance

Disability applicants in the earliest stages of breast cancer don't often have medical records that satisfy the requirements of the breast cancer listing, usually because the cancer hasn't spread or returned after treatment. But even if you don't meet (or equal) the listing, the SSA can find that you're disabled if no jobs exist that you can do with your breast cancer symptoms and limitations. Getting benefits this way is referred to as a "medical-vocational allowance."

In order to determine whether you can work at all, Social Security will decide what restrictions to include in your residual functional capacity (RFC). Your RFC is a description of activities that represent the most you're able to, physically and mentally, in a work setting. For example, because treatments for breast cancer can cause pain and mental fatigue, your RFC will likely include restrictions on how much weight you can lift, how long you can stand for, and whether you can perform skilled or unskilled jobs.

Social Security uses your RFC by comparing it with the duties of your past work and seeing whether the restrictions in your RFC would keep you from doing those jobs. If you can't perform your past work, the agency will then determine whether other jobs exist that you could do, considering your age, education, and any transferable skills you've acquired. In order to be disabled, you'll need to show that you can't perform any other jobs given your vocational profile and the restrictions in your RFC. For claimants younger than 50, this typically means being unable to perform unskilled sedentary work, while claimants 50 and older may have an easier time getting benefits using the "grid rules."

Getting VA Disability Compensation for Breast Cancer

Veterans with service-connected breast cancer can qualify for a disability rating from the VA if they've undergone a mastectomy. Under the VA Schedule of Ratings (38 C.F.R. § 4) diagnostic code 7626, the following ratings will be assigned based on the extent of your surgery for breast cancer:

- Radical mastectomy (removal of the entire breast, underlying pectoral muscles, and regional lymph nodes up to the coracoclavicular ligament) of one breast is a 50% disability rating; both breasts is an 80% rating.

- Modified radical mastectomy (removal of the entire breast and axillary lymph nodes with the pectoral muscles left intact) of one breast is a 40% disability rating; both breasts is a 60% rating.

- Simple mastectomy (removal of all of the breast tissue, nipple, and a small portion of the overlying skin with lymph nodes and muscles left intact) of one breast is a 30% disability rating; both breasts is a 50% rating.

If your breast cancer was treated with a wide local excision (removal of a portion of the breast tissue, including procedures such as a partial mastectomy, lumpectomy, tylectomy, segmentectomy, or quadrantectomy) of the cancer that didn't significantly alter the size or form of the breast, you'll receive a disability rating of 0% for the surgery. While that's not considered a "compensable" rating on its own—meaning you won't get cash benefits based on the diagnosis alone—you'll still qualify for benefits such as access to VA health care services.

SSDI, SSI, and VA Disability Benefit Amounts

Social Security doesn't award benefits based on the type of medical condition you have. Instead, the amount you'll receive if you're approved will depend on whether you're eligible for SSDI or SSI. SSDI eligibility is based on your work history and how much you've contributed to the program in payroll taxes, while SSI is a needs-based benefit available to people with limited resources.

For 2025, the maximum you can receive in SSDI benefits is $4,018 per month (although the average amount is much lower, at $1,580). SSI benefits are tied to the federal benefit rate, which in 2025 is $967 per month minus any countable income you have in that month. Some states also offer modest supplemental payments in addition to the federal SSI rate. You can learn more in our article on SSDI and SSI monthly check amounts.

VA benefits are calculated differently, using a combination of your disability rating and your living situation. For example, in 2025, an individual veteran with no dependents and a 30% rating can get $537.42 monthly in disability compensation from the VA, while a similarly situated veteran with a 60% rating can get $1,395.93 every month. But if these veterans were instead married with one child, the one with a 30% rating would receive $648.42 each month and the one with a 60% rating would receive $1,617.93. (Visit the VA website listing the current disability compensation rates to see the tables used to determine monthly benefit amounts.)

How to Apply for Disability for Breast Cancer

Applying for Social Security disability is a relatively straightforward process. The SSA offers several ways to file for benefits:

- Online at Social Security's website. Filing online has many benefits, such as giving you a dated receipt of your application and letting you finish the application at your own pace.

- Over the phone at 800-722-1213 between 8 a.m. and 7 p.m., Monday through Friday. If you're deaf or hard of hearing, you can call the TTY number at 800-325-0778.

- In person at your local Social Security field office. Field offices are typically open from 9 a.m. to 4 p.m. on weekdays. You may have to make an appointment to file in person.

When you apply for disability benefits, make sure that you let Social Security know the names and dates of your doctors' visits so that the agency can get those important records. Veterans seeking disability compensation can find comprehensive information about applying in our article on how to file for VA benefits.

What If My Breast Cancer Doesn't Qualify for Benefits?

Not everybody with breast cancer will qualify for Social Security disability benefits. In the best case scenarios, the cancer will go into remission within one year, meaning that it's not technically considered a severe impairment by the SSA. (This is also known as the durational requirement.)

This requirement doesn't do much to address the significant financial strain that people with breast cancer often have to deal with while undergoing chemotherapy, radiation, and other treatments that can keep them off work for many months. Even if you don't meet the durational requirement or other technical criteria for SSDI, SSI, or VA benefits, there are other options available that can help tide you over while you're recovering from breast cancer treatment.

Reasonable Accommodations at Work Under the ADA

If you're being treated for breast cancer and need time off from work to receive and recover from treatment, your employer is likely required to provide you with reasonable accommodations under the Americans with Disabilities Act (ADA). Depending on the limitations you're experiencing, accommodations could include flexible shift schedules, remote work options, periodic rest breaks, personal protective equipment such as masks, a workstation heater, or extra time off to attend medical appointments.

Medical Leave for Breast Cancer

The Family and Medical Leave Act (FMLA) is a federal law that allows eligible employees to take up to 12 weeks off work for a serious health condition, including breast cancer. Federal FMLA leave is unpaid, but more and more states are starting to offer their own version of the FMLA that provides paid leave. (You can find out about your state's rules here.) FMLA leave can be a good option for people with a Stage 1 breast cancer diagnosis who will likely respond well to treatment. Under the FMLA, your employer must hold your job for you.

Private Short-Term and Long-Term Disability Insurance

If you get private short-term disability coverage, you might consider filing a claim with your insurer instead of applying for SSDI or SSI. Most employer-provided short-term disability insurance will pay you a certain percentage of your average wages for a time (typically weeks or months) due to an illness or injury you incurred off the job. Long-term disability insurance works in a similar manner, only for an extended duration (usually a year or more). For more information, check out our articles on filing short-term and long-term disability claims.

Do I Need Legal Help?

You aren't obligated to hire a legal professional in order to apply for Social Security, VA, or private disability insurance. But fighting a denial of your claim for benefits can be a source of added stress during a time when you're probably more focused on getting back to health. Having an experienced disability lawyer on your side can save you a lot of effort by handling communications with the relevant agency or insurance provider, gathering your updated medical records, and representing you at a disability hearing (if necessary).