Learn how short-term disability works, what qualifies, and how long your waiting period may be.

Short-term disability (STD) insurance provides cash benefits for workers who are temporarily unable to work due to a non-work-related illness, injury, or pregnancy. Short-term disability insurance typically pays a portion of your regular wages for several weeks to several months. Here's an overview of how short-term disability works, the required waiting periods, and what to do if your STD claim is denied.

- What Is Short-Term Disability?

- Ways to Get Short-Term Disability

- How Long Does Short-Term Disability Last?

- Is There a Waiting Period for Short-Term Disability?

- How Long Does Short-Term Disability Take to Get Approved?

- How Can You Get Short-Term Disability Benefits Quicker?

- How to Apply for Short-Term Disability

- Is My Condition Covered by Short-Term Disability Insurance?

- Filing an Appeal If Your STD Claim Is Denied

- Frequently Asked Questions About Short-Term Disability

What Is Short-Term Disability?

Short-term disability is an insurance policy or a state program (called short-term disability insurance (SDI) or temporary disability insurance (TDI) in some states) that ensures you continue to have income when you're temporarily disabled by an illness, injury, or medical condition that workers' compensation doesn't cover. In some circumstances, STD insurance will pay benefits during pregnancy and recovery from childbirth.

Ways to Get Short-Term Disability

Generally, you can get short-term disability in one of three ways:

- through a group policy as a benefit of employment

- by purchasing an individual policy on the open market, or

- through a state-mandated short-term disability insurance (SDI) or temporary disability insurance (TDI) program.

Only a few states have laws providing short-term disability benefits. California, New Jersey, and Rhode Island require most employers to participate in state-run TDI programs (funded through payroll deduction and taxes on employers). In New York and Hawaii, employers must either purchase SDI for their employees or self-insure.

In states that don't mandate SDI or TDI benefits, many employers choose to provide private disability insurance coverage as a benefit of employment. Some companies pay the premiums entirely themselves, while others require some employee contributions.

If you don't have short-term disability insurance provided by your employer or your state, you can purchase coverage from insurance companies on your own.

SDI or TDI programs vary somewhat, but all are designed to replace some of your wages should an off-work incident or illness cause you to become temporarily disabled. We'll get into the details below.

How Long Does Short-Term Disability Last?

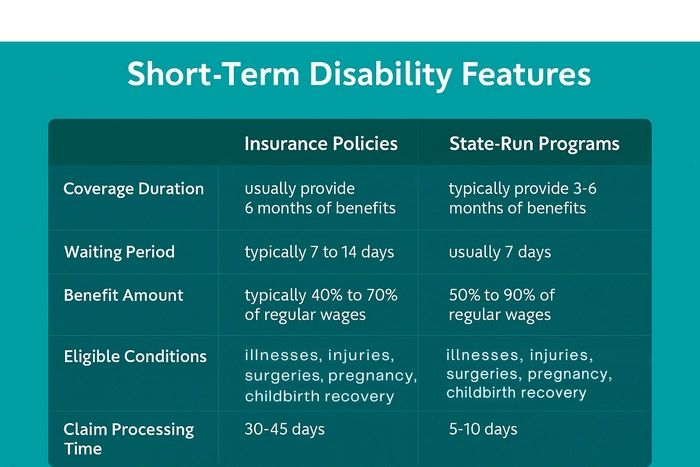

How long your short-term disability benefits last will depend on the terms of your policy or state program. The limits vary, but because short-term disability coverage is designed for temporary disability, a maximum benefit of three to six months (12 to 26 weeks) is common.

Most group short-term disability policies provide benefits for six months. If you're still unable to work at the six-month mark, you might be eligible for benefits from your company's long-term disability (LTD) plan. (Many employers have a companion LTD plan that starts after you've been unable to work for six months. Check with your employer.)

In the states that require short-term benefits, the state sets the length of time you can get benefits. New York, New Jersey, and Hawaii each limit TDI benefits to 26 weeks per year. But in Hawaii, if your employer has an "equivalent or better than statutory" plan, the policy will dictate how long your benefits will last.

Rhode Island TDI benefits can last up to 30 weeks, depending on your earnings and benefit amount. (RI TDI calculates benefit duration using a formula: 36% of your total base period wages divided by your weekly benefit rate.)

In California, most employees can get up to 52 weeks of TDI—but only 39 weeks for people who are self-employed (if they paid into the system).

Most state paid family and medical leave programs provide 6 to 12 weeks of paid medical leave that might overlap with or extend your STD benefits.

And if your disability is expected to last a year or more, you might qualify for Social Security disability.

Is There a Waiting Period for Short-Term Disability?

Almost all short-term disability policies have a waiting period (known as the "elimination period") between the event that caused your disability and when your benefits begin. The waiting period for state-run SDI/TDI programs is usually 7 days. But some plans take longer to start paying benefits, and others kick in as quickly as the first day you miss work.

For employer-purchased or private coverage, the waiting period will usually be one or two weeks but can be as long as 30 days or more—especially for "pre-existing conditions."

For instance, pregnancy is generally covered under group STD policies, but it's often considered a pre-existing condition. So, you might have to be covered by STD insurance for nine months before you can collect any benefits for pregnancy. (Disability insurance policies, unlike health insurance policies, are allowed to impose waiting periods on pre-existing conditions.)

If you have both short-term and long-term disability coverage, your short-term benefits usually last until the waiting period of the long-term disability policy is over. That can be as little as a couple of months or as long as a year, but the average is six months.

How Long Does Short-Term Disability Take to Get Approved?

How long it takes your short-term disability program to process a short-term disability claim will vary, depending on the program's policies. Some claims can be approved (or denied) in as little as five days, especially claims with a state-run program.

Generally, most insurance companies must decide your claim within 30-45 days. But approval can take longer if an insurance company has to wait for copies of your medical records or other information it needs to make a determination.

How Can You Get Short-Term Disability Benefits Quicker?

Here are some things you can do to help the STD insurance claims process go as quickly and smoothly as possible.

Fill Out the Claim Form Completely

If you leave anything blank, it could delay the claims process. If your claim form has a section for your employer to complete (as most state-run SDI/TDI programs and employer-sponsored STD policies do), get it filled out right away.

Be Sure the Information Is Comprehensive

Dot every "I" and cross every "T." When explaining the nature of your injury or illness, include a detailed explanation of the limitations your condition is causing and how they make you unable to do your job.

For example, don't just say you broke your leg. Explain that you can't stand for more than a few minutes or walk without crutches and that your doctor has restricted you to lifting no more than ten pounds.

Provide Medical Evidence That Backs Up Your Claim

Whether it's part of your claim form or a separate form, you'll need a statement from your doctor that describes your disability, including:

- your restrictions and limitations

- the kind of treatment you're getting, and

- when your doctor thinks you'll likely be able to return to work.

For group or individual STD insurance, the insurance company might also need to see medical records that back up your disability claim. Your insurance company might want to see any of the following:

- the results of lab tests or X-rays

- doctor's office records

- your prescription history, and

- records from hospital visits.

Get Your Claim Form in Quickly

The insurance company can't start processing your claim until you submit the paperwork (more on this below). The longer you take to file your claim, the longer it'll take for you to start receiving benefits. Be sure to follow the submission instructions.

Ask Your Insurance Provider

If you're unsure about the claims procedure, where to send your claim form, or anything else regarding the claims process, call the administrator and ask. You can also ask how long it will take to process your claim and when you can expect to begin getting benefits once it's approved.

How to Apply for Short-Term Disability

The first step to getting short-term disability benefits is to obtain a copy of the claim form from your employer's human resources department or your own insurance carrier (if you purchased coverage for yourself). This form will usually ask for the following information:

- the date you last worked

- a description of your medical condition

- some personal information, and

- your contact details.

Next, you'll have to request that your employer and physician complete their portions of the claim form. Your employer will provide information about your job description, salary, and history with the company, while your doctor will generally be required to certify that your medical condition prevents you from working.

After you submit the claim form to the insurance carrier or state agency that administers the program, the insurance program's claims administrator will request your medical records and review them to make sure they're consistent with the disability you're claiming.

Learn more about filing for short-term disability benefits.

Is My Condition Covered by Short-Term Disability Insurance?

If you've just started your job and need to file a short-term disability insurance claim, check the terms of your policy to see whether your coverage has started yet. Many plans require that you've worked a certain amount of time (six months is common) before coverage begins. And many employers require that you exhaust your paid sick leave before you can draw any STD benefits.

Injuries

If you have an injury that isn't work-related and it prevents you from working—that is, you can't perform the material duties of your job—you'll likely be eligible for STD benefits. For instance, let's say you broke your leg skiing. If your job requires you to be on your feet for long periods of time (like a restaurant worker or delivery person), your injury would likely qualify you for short-term disability because you can't perform the basic duties of your job. (Read more in our article on short-term disability for injuries and accidents.)

Surgery

Most surgeries are covered by short-term disability insurance as long as your doctor certifies that the procedure is "medically necessary." (Organ donation is an exception to the "medically necessary" provision. It's generally covered.) Bariatric (weight-loss) surgery is often covered by STD insurance, but not always, so check the terms of your plan. And SDI in some states, including California, covers time off for cosmetic surgery, as long as you can't work during the recovery period. (Read more in our article on short-term disability for operations and surgical procedures.)

Pregnancy

Pregnant women are generally eligible for short-term disability benefits for a few weeks to several months, covering the end stages of pregnancy and a period of recovery after delivery. But for employer-purchased or individual STD policies for pregnancy, coverage typically can't begin until nine months after your policy goes into effect (because of the pre-existing condition rule).

Illnesses

All illnesses that aren't work-related (like mesothelioma or asthma) can qualify for short-term disability benefits if they prevent you from doing your job. But some employer-paid group policies deny coverage for severe pre-existing conditions like cancer, AIDS, or heart disease, at least for a period of three to six months.

Medication Side-Effects

Some prescription medications can cause such severe side effects that they can also give rise to a successful STD claim. The same goes for some types of chemotherapy.

Learn more about who qualifies for short-term disability benefits.

Filing an Appeal If Your STD Claim Is Denied

In general, short-term disability claims are less likely to be denied than those for long-term disability insurance or Social Security disability. But short-term disability denials aren't uncommon.

If your initial claim for STD benefits is denied, you should seriously consider filing an appeal, either on your own or with the help of an attorney. The instructions and deadlines for appealing your denial are usually contained in your denial letter, along with an explanation of why your claim was denied.

When filing your appeal, you'll need to collect as much medical evidence as possible to strengthen your case. Supplementing your claim file with additional doctors' opinions and medical records can greatly increase your chances of winning your appeal. Even written statements from friends, family members, and (perhaps most importantly) your boss or co-workers who have observed your struggles can be beneficial.

If you feel like you're facing an uphill battle, hiring a disability attorney for your appeal can make sense. An attorney will not only handle the paperwork and deadlines associated with your appeal, but an attorney will also understand what sorts of evidence will persuade the insurance company or state program that you're unable to work.

Learn more about appealing a short-term disability denial.

Frequently Asked Questions About Short-Term Disability

The following are answers to some frequently asked questions you might have about short-term disability insurance. Because every state program, employer plan, and individual policy is different, check with a program administrator or insurance company for details specific to your situation.

How Much Are Short-Term Disability Benefits?

Employer-sponsored and private short-term disability insurance generally pays between 40% and 70% of your pre-tax income (gross pay). The exact percentage and the maximum benefit amount depend on your specific policy.

State short-term disability programs pay between 50% and 90% of your income up to a maximum benefit amount, which varies greatly from state to state. For instance, the maximum SDI benefit in California is $1,681 per week (in 2025), while the maximum benefit amount under New York's disability benefit law (DBL) is just $170 per week.

Does Short-Term Disability Insurance Protect Your Job While You're Off?

No. Employer-sponsored SDI and private short-term disability insurance policies don't guarantee job protection—they only provide income while you're unable to work because of a temporary disability.

But your job might be protected under state or federal laws. If your leave also qualifies under the federal Family and Medical Leave Act (FMLA) or the Americans with Disabilities Act (ADA), your employer must generally return you to the same or a similar position when your short-term disability leave ends.

Some states have laws similar to the FMLA that allow new parents or employees with serious health conditions to take unpaid time off and get their jobs back when they return. And several states' disability or paid medical leave programs include built-in job protection while you're on leave, without the need for a separate law like the FMLA.

Can You Work Part-Time While Receiving Short-Term Disability?

It depends on your STD insurance policy or state program. Many employer-sponsored plans define disability as the "inability to perform the material duties of your regular occupation and inability to earn 80% or more of your covered earnings from working in your regular occupation." So, some policies allow you to work part-time and still receive reduced STD benefits, while others prohibit working altogether during your leave.

If your insurance policy doesn't specifically address part-time work, you might be able to work as long as your earnings stay below the plan's threshold—typically 80% of your regular income—and your job complies with any medical restrictions from your doctor. Always report any wages you earn to the insurance company, and check your employer's policy about working for another company while you're on medical, FMLA, or short-term disability leave.

Most state STD programs, such as California's, allow you to work part-time and collect partial benefits as long as you experience a loss of wages due to your disability.

What Happens When My Short-Term Disability Benefits Run Out?

If your short-term disability payments expire (because you've received them for the maximum period of time), and you're still unable to work, you might be able to apply for:

- long-term disability benefits

- Social Security disability, or

- other government benefits to which you might be entitled.

A disability attorney can assist you in filing for longer-term benefits if and when the time comes that you need them.

- What Is Short-Term Disability?

- Ways to Get Short-Term Disability

- How Long Does Short-Term Disability Last?

- Is There a Waiting Period for Short-Term Disability?

- How Long Does Short-Term Disability Take to Get Approved?

- How Can You Get Short-Term Disability Benefits Quicker?

- How to Apply for Short-Term Disability

- Is My Condition Covered by Short-Term Disability Insurance?

- Filing an Appeal If Your STD Claim Is Denied

- Frequently Asked Questions About Short-Term Disability