The date you became disabled and the date you applied for benefits are important in calculating the amount of SSDI or SSI backpay you'll get. We’ll show you how your back pay amount is calculated.

Almost every applicant who is awarded Social Security disability insurance (SSDI) or Supplemental Security Income (SSI) benefits also gets past-due disability benefits (also known as "disability back pay"). The past-due monthly payments go back to the date the applicant filed their disability application, and sometimes even earlier.

How far back you'll get disability back pay depends on whether you're approved for SSDI or SSI benefits. Either way, the longer it takes Social Security to decide your claim, the more disability back pay you'll get.

- How Is SSDI Back Pay Calculated?

- Examples of How SSDI Back Pay Is Calculated

- How Much SSI Back Pay Will I Get?

- Does Social Security Give Back Pay to Everyone Approved for Disability?

- How Long Does It Take to Get an SSDI or SSI Back Pay Check?

- Will I Get My Disability Back Pay in a Lump-Sum Payment?

- Will My Disability Back Pay Be Taxed?

- Can I Get Back Pay Based on a Date Other Than My Application Date?

How Is SSDI Back Pay Calculated?

The amount of your Social Security disability back pay will depend on three factors:

- the date you apply

- the date you became disabled, and

- the date you're approved for benefits.

1) Your Application Date

The first factor that determines how much disability back pay you'll get from Social Security (also known as the "Social Security Administration," or "SSA") is the date you apply for disability benefits.

Payment for the months following your application date. If you became disabled five months before your application date, you can get back pay going back to your application date. You'll receive back payments for the months between your application date and your approval date at your monthly benefit rate.

It can take Social Security anywhere from three months to about 24 months to approve you for benefits, which can mean a big backpay check. For instance, if you're approved 10 months after you apply, if your monthly SSDI payment is $1,600, you'll receive $16,000 in back pay.

But, for SSDI, not everyone receives benefits going back to the date they apply. You'll receive past-due benefits going back to your application date only if you were disabled before that date. That might sound strange, but it's because most SSDI recipients have a five-month waiting period before they can receive benefits (more on this waiting period below).

Payment for the months before your application date. In addition to back payments, you might be able to get "retroactive benefits" going back to the date you first became disabled, which is often many months before the application date. Most people don't file for disability benefits on the same day they stop working due to a disability. On average, it takes about 8 months for people to finally apply for disability benefits (6 months for those age 60 and older, 11 months for those under 48).

An SSDI "claimant" (applicant) can get up to 12 months of retroactive benefits (going back to one year before the application date), but not everyone gets this amount. You can get retroactive pay for a year before the application date only if you became disabled long before your application date (up to 17 months before you apply). Exactly how many months of retroactive benefits you can get depends on the date you became disabled.

2) Your Date of Disability

The onset date of your disability—that is, when your disability began—is also when your SSDI waiting period begins.

When an SSDI claimant files an application for disability benefits, they indicate (on the application) when they think their disability began. This date is known as the "alleged onset date," or "AOD." But when Social Security approves a disability application, the agency gives the claimant an "established onset date," or "EOD." It's not always the same as the AOD.

The EOD is the date that Social Security has decided that a claimant's disability began for payment purposes. After looking at all the facts of the claim, a disability claims examiner or an administrative law judge (if the case went to a hearing) will set the EOD based on the claimant's medical records and work history. The EOD is often the date a claimant stopped working, but it can also be the date of an accident or the date of a test that a doctor used to diagnose an illness.

Whether benefits will be payable back to the beginning of the 12-month retroactive period depends on how long ago your disability onset date was. Here's where the other twist in calculating the SSDI benefit start date comes in: the waiting period.

3) Your Waiting Period

The third factor that affects when SSDI benefits begin (and how much back pay you'll get) is the five-month waiting period. Essentially, after Social Security assigns SSDI applicants an established onset date, the agency pauses the start of benefits for five months. (This rule doesn't apply to applicants with ALS, or Lou Gehrig's disease—they get paid starting on their disability onset date.)

If you apply for benefits soon after you become disabled and Social Security decides your claim right away, you might not get any back pay—you'd still be within the five-month waiting period when you get your approval letter. In that case, your monthly payments would just start at the end of your waiting period. (The first of the month after your waiting period ends is called your "date of entitlement" (DOE), which is when the SSA starts owing you monthly benefits.)

But most people do get some retroactive pay because they waited many months to apply for benefits. For these applicants, the waiting period doesn't start after they apply, but earlier, right after the date their disability began. This date could be just a couple of months before or several months or years before the application date.

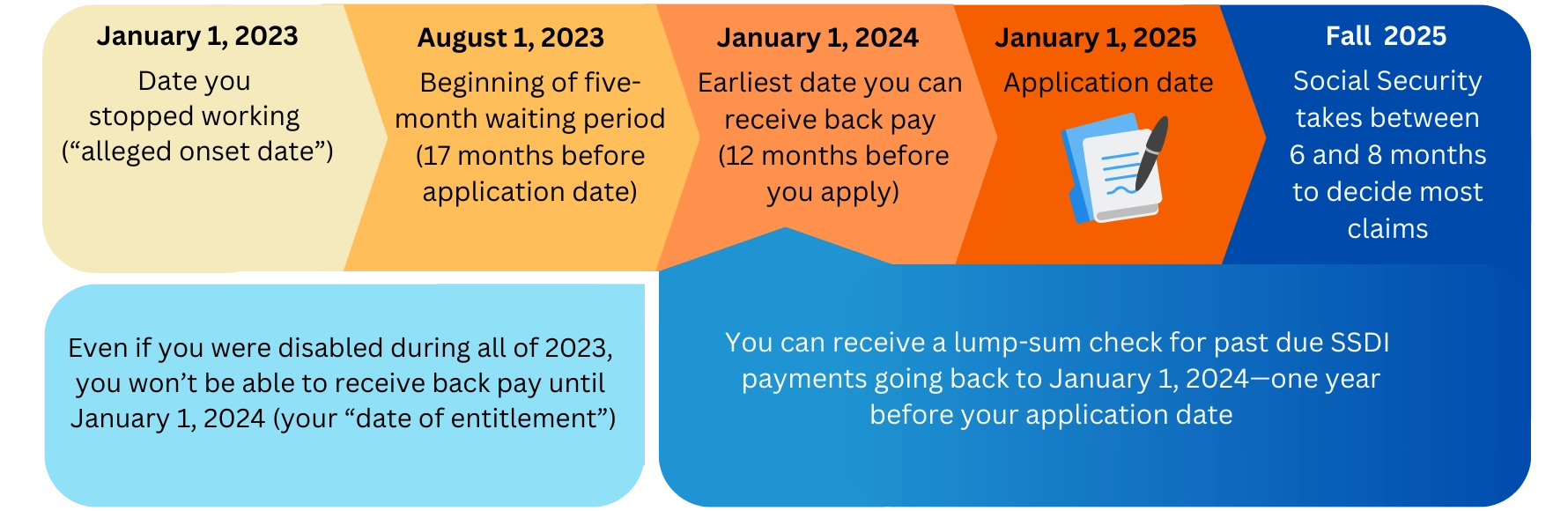

But for payment purposes, Social Security has a rule that the five-month waiting period can't start any earlier than 17 months before the application date, meaning that the farthest back benefits can be paid back is one year before the application date.

Examples of How SSDI Back Pay Is Calculated

Combining all the rules and timelines here can get pretty complicated for SSDI recipients. It helps to look at a few examples to understand how the five-month waiting period affects back pay. Let's focus on some example situations where your disability onset date was today, one year ago, and two years ago.

Your Disability Begins This Month

If you become disabled now and you apply for benefits today, Social Security won't owe you any retroactive benefits when you're approved. The SSA will start your payments in the sixth full month after this month, to account for the five-month waiting period. For example, say today is January 20, 2025. Your benefits will start July 1, 2025 (your waiting period would be from February through June 2025). July 1, 2025 is your date of entitlement (EOD). When your SSDI benefits will actually begin is a different story; there's a good chance your claim won't be decided by your date of entitlement. So, even though Social Security won't owe you retroactive benefits, they're likely to owe you some past-due payments because it will take them many months to decide your case. After the SSA makes a decision, you'll get back pay from your date of entitlement to the date of your first monthly payment. In this example, if Social Security decides your claim on January 1, 2026, you'll receive six months of back pay, going back to July 1, 2025.

Your Disability Began a Year Ago

If you became disabled one year ago today and you apply today, Social Security will owe you some retroactive benefits when you're approved for benefits. Your date of entitlement—the date Social Security starts owing you benefits—will be seven months ago (12 months minus the five-month waiting period). For example, if today is January 20, 2025, and the SSA agrees you became disabled January 20, 2024, your date of entitlement would be July 1, 2024. (Your waiting period would be February through June 2024). You would be paid 7 months of retroactive benefits. To get a full 12 months in back pay, your disability must have begun at least 17 months before you apply, due to the five-month waiting period.

Your Disability Began Two Years Ago

If the SSA agrees you became disabled two years ago today and you apply today, your date of entitlement will be 12 months ago. For example, if today is January 1, 2025, and you became disabled January 1, 2023, your date of entitlement would be January 1, 2024. (Your waiting period would be August through December of 2023). You do get a full year (12 months) of retroactive pay in this case, but you can't get more than that even though you became disabled so long ago. Again, Social Security doesn't allow your date of entitlement to be more than 12 months before your application date (or your waiting period to start more than 17 months before your application date).

How Much SSI Back Pay Will I Get?

Calculating back pay for SSI is much simpler than Social Security back pay. SSI doesn't award retroactive payments, so SSI claimants can't get benefits for the months they were disabled before they applied. The only back pay SSI recipients receive is for the months during which the SSA was deciding their claim.

Here are the specifics.

The earliest you can receive past-due SSI benefits is the first of the month after the month in which you filed your application. In other words, if you're approved for benefits, you'll receive a past-due payment for the first full month after your application date, and every month until your approval date. For example, if you applied for SSI on August 15 and were approved on November 30, you'll receive past-due benefits for the months of September, October, and November.

But if Social Security says your disability onset date is actually after the application date—which does happen—your benefits would start the first of the month after the month in which the SSA says you became disabled. For example, if you applied for SSI on August 15 but the SSA says you didn't become disabled until you stopped work altogether in November, your first payment would be December 1.

Does Social Security Give Back Pay to Everyone Approved for Disability?

Almost everyone who's approved for disability gets backpay, whether the claim is for SSDI or SSI or both. That's because Social Security disability cases take a long time from application to decision, often a year or more. During that time, the meter is running, so to speak, and you're entitled to receive monthly payments from when you first applied for disability benefits (or even earlier for SSDI claims, as explained above).

There's one exception to the "nearly everyone gets backpay" rule: SSDI recipients who have compassionate allowance conditions or terminal illnesses may not get much backpay. Here's why. Applicants with expedited claims are usually approved for benefits within two to three months, but the SSDI program has a five-month waiting period, as discussed above.

For example, if someone finds out they have esophageal cancer (a compassionate allowance condition), applies for benefits within a month or two of the diagnosis, and then gets approved for benefits three months later, they may still have some time left in their waiting period when the decision comes out. That means Social Security wouldn't owe the applicant any past due benefits. So, for applicants with expedited claims, only those whose disability onset date was well before their application date will get a significant amount of backpay.

How Long Does It Take to Get an SSDI or SSI Back Pay Check?

Sometimes people receive their back pay check before their regular monthly payments start, and sometimes they have to wait a few weeks after their monthly benefits start for the backpay check to arrive. Social Security generally takes about three weeks to two months to start sending your regular monthly payments.

Read more about when you'll receive your back pay from Social Security.

Will I Get My Disability Back Pay in a Lump-Sum Payment?

All SSDI (Social Security disability insurance) back pay is paid as one lump sum.

But Social Security will pay SSI (Supplemental Security Income) back pay in one lump-sum payment only if it's a small amount (under a couple thousand dollars). The SSA will split larger amounts of back pay into three payments, each six months apart. But if you have necessities you need to buy (such as a car) or certain types of debts to pay off, you can request a higher amount for your first or second installment payment.

Learn more about when and how SSI back pay is paid in installments, and the exceptions to the rule.

Will My Disability Back Pay Be Taxed?

Neither SSI back pay nor SSI monthly payments are taxed.

On the other hand, SSDI benefits are subject to tax, and so is SSDI back pay. Your lump-sum check for SSDI back payments will be taxable if your income is over a certain amount. And receiving a large amount of SSDI back pay at one time could potentially bump you into a higher tax bracket, spelling a sizeable tax bill.

Fortunately, the IRS won't penalize you for receiving what could be two years' worth of back pay all in one year. There's a way to file your taxes so that your back payments get separated into several years. For more information, read our article on how back pay is taxed.

Here's a summary of the differences between SSDI and SSI back pay that we've discussed.

|

Feature |

SSDI |

SSI |

|

Retroactive Pay |

Up to 12 months before application |

Not available |

|

Back Pay Period |

Application date to approval date (potentially minus five months) |

Month after application to approval date |

|

Payment Method |

Lump sum |

Lump sum or up to three installments |

|

Taxable? |

Yes, potentially |

Not taxable |

Can I Get Back Pay Based on a Date Other Than My Application Date?

Social Security sometimes lets your effective application date be earlier than the actual date you completed applying. Your "effective application date" could be the day when you first started an online application for benefits or the day you called the SSA and told them you wanted to apply for benefits. The earlier date is called a "protective filing date."

If you have a protective filing date that's earlier than the actual date you filed your disability application, you can get disability benefits going back to that date (as if it were your application date). Getting a protective filing date can increase both SSDI back pay and SSI back pay. For more information, see our article on protective filing dates.

It can be difficult, but well worth it, to convince Social Security to use a protective filing date. But in some cases, you might need the help of a legal professional.

It's also sometimes possible, with the help of a lawyer, to get back pay going back to the date of a prior application. (For more information, read our article on getting back pay based on a prior disability application.)

- How Is SSDI Back Pay Calculated?

- Examples of How SSDI Back Pay Is Calculated

- How Much SSI Back Pay Will I Get?

- Does Social Security Give Back Pay to Everyone Approved for Disability?

- How Long Does It Take to Get an SSDI or SSI Back Pay Check?

- Will I Get My Disability Back Pay in a Lump-Sum Payment?

- Will My Disability Back Pay Be Taxed?

- Can I Get Back Pay Based on a Date Other Than My Application Date?