Adults who are disabled may be eligible to receive Social Security disability benefits based on their parents' earnings.

Most people think of Social Security Disability Insurance (SSDI) as a program for retired people and disabled workers nearing retirement. But younger people who are unable to work can also collect disability benefits through their parents' SSDI eligibility, even if they themselves don't meet the earnings requirements for the program. Social Security refers to a beneficiary who receives SSDI in this manner as a "disabled adult child."

While the term "adult child" might seem contradictory, it just means that even though you're over the age of 18, you're collecting SSDI benefits based on your parents' work history instead of your own. So even if you don't qualify for the needs-based Supplemental Security Income (SSI) program, you may be able to get benefits as a disabled adult child—and these benefits can be more substantial than what you'd receive from SSI.

- What Are Disabled Adult Child (DAC) Benefits?

- Disabled Adult Child Benefits Amount

- How Do I Qualify as a Disabled Adult Child?

- How Long Can an Adult Child Collect Social Security On Their Parents' Record?

- Do DAC Benefits Come With Back Pay?

- VA Benefits for a Disabled Adult Child

- How to Apply for Disabled Adult Child Benefits

What Are Disabled Adult Child (DAC) Benefits?

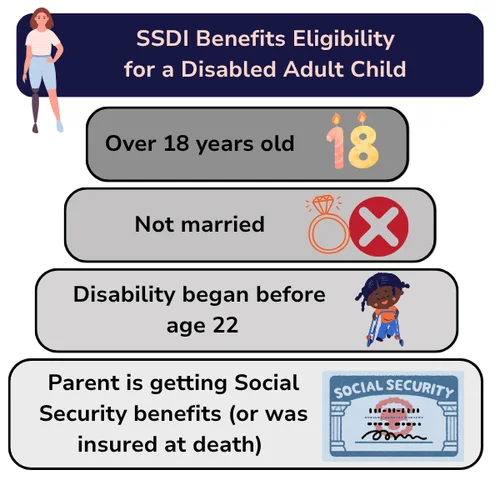

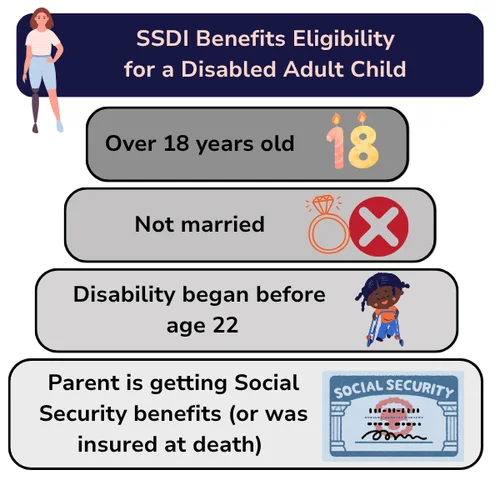

Usually, SSDI benefits are available to people who have worked and paid Social Security taxes for years before they became disabled. Social Security recognizes that most young people haven't been able to work for long enough to qualify for SSDI on their own, so in certain circumstances, you can receive disability benefits under your parents' SSDI. You're considered a disabled adult child if you meet the following criteria:

- you're over the age of 18

- you aren't married

- you have a disability that began before you were 22, and

- one of your parents currently receives Social Security benefits, or was insured for Social Security benefits at the time of their death.

If you qualify as a disabled adult child, you can receive monthly payments through SSDI. The amount of these payments will be calculated based on your parents' work history. (In general, Social Security benefits that are based on a parent's earnings record are called "auxiliary benefits," or dependents benefits.) There's no requirement that you live with your parents to receive adult child benefits.

Disabled Adult Child Benefits Amount

Social Security pays benefits to disabled adult children based on the parent's primary insurance amount (PIA). The PIA is the amount a person would get if they begin receiving benefits at full retirement age (67). The formula for calculating PIA is complex, and the amount will vary based on your parent's past work and payroll contributions to the disability trust fund.

You can receive one-half of your living parent's PIA, or three-fourths if your parent is deceased. For example, in 2026, the maximum PIA is $4,152 per month. If your parent was entitled to the maximum, your benefits would be slightly over $2,000 if your parent is alive, or about $3,000 if deceased. But the average PIA is much lower, about $1,630 per month. Assuming your parent's PIA is closer to the average, you'd receive about $800 if your parent is alive or $1,200 if deceased.

Additionally, after you've received SSDI benefits for two years, you can qualify for Medicare as a disabled adult child. Your benefits will continue for as long as you have a disability.

How Do I Qualify as a Disabled Adult Child?

In order to be eligible for SSDI as a disabled adult child, you must have a disability that began before you were 22. Social Security will determine whether you're disabled using the same process that they use with any adult who is applying for benefits. You must show the following in order to be considered disabled for purposes of collecting SSDI:

- you have a medically determinable impairment that has lasted 12 months, is expected to last 12 months, or is expected to result in death, and

- your impairment, or the treatment for your impairment, causes you to be unable to perform substantial gainful activity.

There are a few different ways you can show that you can't perform substantial gainful activity—by meeting a listed impairment, equaling a listed impairment, or showing that your functional limitations keep you from working at any full-time job.

Qualifying as Disabled by Meeting a Listed Impairment

Social Security maintains a list of medical impairments that they consider especially severe. If your impairment is on the list and your medical record contains evidence that the agency has already determined is enough to prevent you from working, your disability application will be approved.

Qualifying as Disabled by Equaling a Listing Impairment

Even if you don't exactly meet the criteria for a listing, you can still be found disabled if Social Security thinks that your condition is equivalent in severity to a listed impairment (you "medically equal" a listing). You can also have a combination of conditions that don't by themselves meet a listing, but when added together can medically equal a listed impairment.

Qualifying as Disabled by Being Unable to Perform Any Job

Most people don't meet the strict criteria to be found disabled under the listing of impairments. But you can still be found disabled if your conditions prevent you from working even the easiest jobs full-time. The process of determining what you can and can't do in a work environment is called assessing your residual functional capacity (RFC). If there aren't any jobs that you can do given your RFC, Social Security will award you disability benefits.

How Long Can an Adult Child Collect Social Security On Their Parents' Record?

Disabled adult children can continue to collect SSDI on their parents' record for as long as they meet the agency's definition of disability or they get married (in most situations). The most common reason why disability benefits are terminated is when Social Security has determined that, following a continuing disability review, your disabling medical condition has improved to the point where you're able to work full-time.

I Got Married, Can I Still Receive Benefits?

If you were receiving SSDI as a disabled adult child and you get married, in most cases you won't be able to receive SSDI benefits anymore. However, if you get married to another person who's receiving disabled adult child benefits, you may still be able to receive SSDI benefits. For more information on your specific situation, contact your local Social Security office.

I'm Working, Can I Still Receive Benefits?

You can work as long as you want and still receive disability benefits if your earnings never rise to the level of substantial gainful activity (SGA). For 2025, the SGA amount is $1,620. You're also entitled to a trial work period of about nine months where you're allowed to earn over the SGA amount without putting your disability benefits at risk. If you're earning above the SGA amount for longer than nine months, Social Security might end your benefits.

If you're interested in trying to get back to full-time work, Social Security runs a Ticket to Work program that provides services like vocational training, career counseling, and job placement assistance.

What If I'm Receiving SSDI Based on My Own Earnings?

If you've worked enough to be eligible for SSDI based on your own earnings, but you think you could qualify as a disabled adult child, you should contact your local Social Security office. If you're eligible as a disabled child, you could receive a higher amount of monthly payments based on your parent's earnings.

Do DAC Benefits Come With Back Pay?

Yes, if you are awarded SSDI based on your status as a disabled adult child, you'll be entitled to any back pay just as you would if you had been approved based on your own work record. The amount of your back pay will depend on your disability onset date and when you first filed your application for benefits. SSDI back pay is disbursed as a lump sum amount. After that, you'll receive your ongoing benefits every month, with the exact payment schedule dates determined by your birthday.

For more information, see our articles on when you'll receive your SSDI back pay and how to handle large amounts of disability back pay.

VA Benefits for a Disabled Adult Child

As with Social Security, the VA also provides dependents' benefits to family members of disabled veterans, although the benefits are administered differently. Veterans who are receiving Disability Indemnity Compensation from the VA and have an adult child who became permanently unable to support themselves before age 18—known by the VA as a "helpless child"—can receive additional monthly disability compensation. Contact your local VA office for more information about the helpless child benefit.

How to Apply for Disabled Adult Child Benefits

You can't yet apply for SSDI benefits as a disabled adult child online. Instead, you'll need to call the national Social Security hotline at 800-772-1213 (TTY 800-325-0778) between the hours of 8:00 a.m. and 7:00 p.m., Monday through Friday, to speak with a representative. Or, you might make an appointment at your local Social Security field office. To speed up the process, you can complete an Adult Disability Report and have it available at the time of your appointment.

You aren't required to get a lawyer for any part of the disability determination process, but it's usually a good idea, especially if you need to appeal a denial or attend a disability hearing. An experienced disability attorney will be able to help you gather necessary medical records, handle communications with Social Security, and make persuasive arguments that you meet the criteria of a disabled adult child. Disability lawyers work on contingency, meaning they don't get paid unless you win, so there's little risk in working with one to strengthen your case.

- What Are Disabled Adult Child (DAC) Benefits?

- Disabled Adult Child Benefits Amount

- How Do I Qualify as a Disabled Adult Child?

- How Long Can an Adult Child Collect Social Security On Their Parents’ Record?

- Do DAC Benefits Come With Back Pay?

- VA Benefits for a Disabled Adult Child

- How to Apply for Disabled Adult Child Benefits