Disability claimants in Minnesota have a better chance of getting disability benefits than those who live elsewhere.

If you live in Minnesota and have a medical condition that keeps you from being able to work full-time for at least one year, you may be considering filing for disability benefits. You wouldn't be alone—according to recent agency data, about 3.4% of Minnesotans receive Social Security Disability Insurance (SSDI) and 1.5% receive Supplemental Security Income (SSI).

SSDI and SSI are both federal programs with the same application process no matter where in the country you live. But because disability claims are initially handled by examiners at the state level, there is some important information (such as approval ratings) of particular importance to Minnesota residents. Knowing what to expect at the state level and beyond can increase your overall chances of getting benefits.

- How Do I File for Social Security Disability in Minnesota?

- What Disability Program Should I Apply For?

- What Medical Conditions Qualify for Disability in Minnesota?

- Who Decides Whether I'm Disabled in Minnesota?

- How Do I Appeal a Denial of Benefits in Minnesota?

- How Much Does Minnesota Pay in Disability Benefits?

- Minnesota Vocational Rehabilitation Services (VRS)

- Do I Need a Minnesota Lawyer to Help With My Disability Claim?

How Do I File for Social Security Disability in Minnesota?

Filing for SSDI or SSI is a fairly straightforward process. There are multiple ways you can apply for Social Security disability benefits:

- Use the application tool provided on Social Security's secure website. Before you start, you may first want to read our article with tips for applying online.

- Call Social Security's national number at 800-772-1213 from 8:00 a.m. to 7:00 p.m., Monday through Friday, to speak with a representative. If you're deaf or hard of hearing, you can use the TTY number at 800-325-0778.

- File in person at one of the 17 Social Security field offices in Minnesota. Offices are typically open weekdays from 9 a.m. to 4 p.m., but you may need to make an appointment.

For more comprehensive details, including what personal information you should have on hand when you apply, check out our article on filing a disability claim with Social Security.

What Disability Program Should I Apply For?

SSDI and SSI—also referred to as Title II and Title XVI—are the two types of disability benefits provided by Social Security. Although the agency's definition of disability is the same for both programs, each benefit has its own preliminary eligibility criteria ("technical qualifications") that you must satisfy in order to legally receive payment.

For SSDI, this means having enough work credits to be insured under the program on the date you became disabled. (Work credits are earned by paying into the program through payroll or self-employment taxes.) SSI, on the other hand, is a needs-based benefit available to people with limited income and resources, regardless of work history.

You can file for both programs and let Social Security figure out which ones you qualify for, but you must be financially eligible to receive at least one of the two benefits. If you're "overresourced" for SSI and you don't have enough work credits to get SSDI, you can't receive any benefits no matter how severe your disabling symptoms are.

What Medical Conditions Qualify for Disability in Minnesota?

Any severe impairment may qualify you for disability benefits, provided that you have enough medical evidence to show that you either meet a listing or are unable to work at any job. While the exact type of evidence will vary depending on your specific condition, it's key to have documentation of regular doctor's visits, objective imaging such as X-rays or MRIs, and reports from physical or mental evaluations conducted by your medical providers.

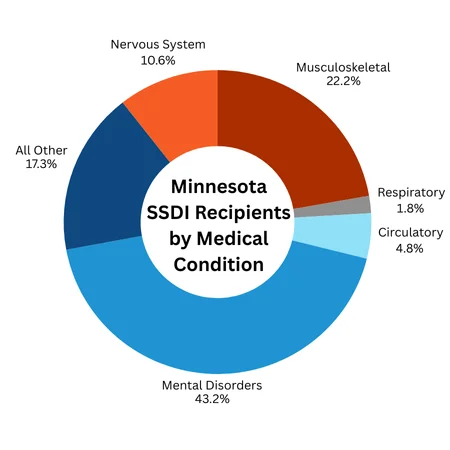

The chart below illustrates the percentage of SSDI recipients in Minnesota who were found disabled based on the most commonly awarded medical conditions:

Source: Annual Statistical Report on the Social Security Disability Insurance Program, 2023

Regardless of your specific diagnosis, you'll need to submit medical records from your doctors. Minnesota law limits how much medical providers can charge you if you need the records to appeal a Social Security disability denial, meaning your doctor's office can't make you pay more than a $10 retrieval fee (and can't add extra per page or X-ray costs). And if you're on public assistance in Minnesota, you can get your medical records completely free of cost, provided you have a public assistance statement or legal aid letter. (Minn. Stat. §144.292)

Who Decides Whether I'm Disabled in Minnesota?

After you've submitted your application, Social Security will make sure that you meet the technical qualifications for receiving benefits. Your file is then passed on to Disability Determination Services, or "DDS," the state agency tasked with processing disability claims in Minnesota. There, a claims examiner—with help from a medical consultant—reviews your records and determines whether you're disabled.

DDS handles claims at the initial stage and on reconsideration (the first level of appeals). If you're denied following reconsideration—a process where a different claims examiner than the first one reviews your case again—your file is sent to Social Security's Office of Hearing Operations, or OHO, where you'll be scheduled for a hearing with an administrative law judge.

How Do I Appeal a Denial of Benefits in Minnesota?

Approximately three to five months after you file for disability, you'll receive a written decision in the mail. Statistically, 43% of disability claims in Minnesota were approved at the initial application stage—above the national average of 38.3%—and 12.7% were approved following reconsideration review (below the national rate of 15.9%). So if you aren't approved on your first try, you'll need to appeal, probably twice, until you get the opportunity to speak with a disability judge.

Request for Reconsideration

If you've been denied benefits after initial review, the first step is to send a request for reconsideration to Social Security. You have 60 days from the date you receive your disability denial letter to submit the reconsideration request, and it takes about seven months for your claim to be processed.

Request for a Disability Hearing

If you're still not awarded benefits after reconsideration, you can then request a hearing in front of an administrative law judge. Your case will be assigned to a judge at the OHO in Minneapolis, who will schedule your hearing in person, over the phone, or by videoconference. For the Minneapolis OHO, the average wait between the date a disability hearing is requested and when it takes place is 7 months. You can find the contact information for the office below.

Office of Hearings Operations

250 Marquette Ave.

Suite 300

Minneapolis, MN 55401

Phone: (877) 512-3856

Fax: (833) 619-0551

As of the fiscal year ending July 2025, judges in the Minneapolis OHO issued 2,538 decisions on disability claims. 1,385 of those decisions resulted in either fully or partially favorable outcomes, resulting in an approval rate of about 55%.

How Much Does Minnesota Pay in Disability Benefits?

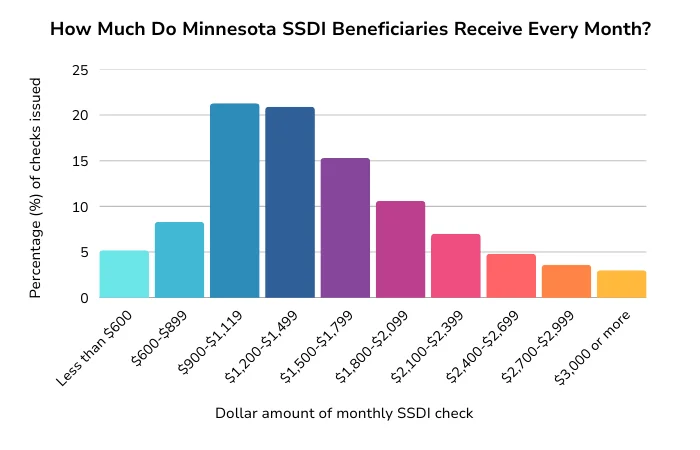

Because SSDI and SSI are federal benefits, the amount you'll receive doesn't change from state to state. SSDI payments are particularly tailored to each beneficiary since they're calculated based on your individual earnings record, which can vary significantly between each person. The chart below shows the distribution of SSDI payments for beneficiaries in Minnesota:

Source: Annual Statistical Report on the Social Security Disability Insurance Program, 2023

Minnesota residents who receive SSI may be eligible for a modest state supplement in addition to the federal benefit rate. Minnesota Supplemental Aid (MSA) varies between $81 and $112.86 per month, depending on your living arrangements. To learn more about MSA or apply for benefits, visit https://mnbenefits.mn.gov/.

Minnesota's state tax treatment of disability benefits can be complex. SSI benefits are not taxed, but SSDI benefits can be subject to state tax once you reach a certain income threshold. The table below shows the amount of adjusted gross income on your federal return at which SSDI benefits may be taxed by the state of Minnesota.

|

Married taxpayers filing joint returns |

Single or head of household taxpayers |

Married taxpayers filing separate returns |

|

|

Social Security fully tax exempt |

$108,320 or less |

$84,490 or less |

$54,160 or less |

|

Some federally taxable benefits subject to state tax |

$108,321 to $144,320 |

$84,491 to $120,490 |

$54,161 to $72,160 |

|

All federally taxable benefits subject to state tax |

$144,321 or greater |

$120,491 or greater |

$72,161 or greater |

Keep in mind that while the above table represents the 2025 thresholds, the exact amounts are adjusted each year to account for inflation.

Minnesota Vocational Rehabilitation Services (VRS)

Minnesota's Employment and Economic Development Department hosts a range of vocational rehabilitation programs designed to help people with disabilities find and maintain jobs. These services include individual job placement, workplace training, and independent living assistance. You can fill out this interest form to get connected with a VRS representative, or visit the VRS website to learn more.

Do I Need a Minnesota Lawyer to Help With My Disability Claim?

You aren't obligated to hire an attorney at any stage of the disability determination process, but it's generally a good idea. Your chances of winning are much higher if you're represented by an experienced lawyer. And while disability attorneys can be licensed in any state in order to represent you for your Social Security claim, it can be beneficial to have a local lawyer who is familiar with Minnesota's DDS claims timeline and the judges at the Minneapolis hearing office.

Disability attorneys typically work on contingency—meaning they don't get paid unless (and until) you win your case—so there's little upfront cost to hiring one. Many offer free consultations, so it doesn't hurt to ask around until you find a lawyer who's a good fit for you.

- How Do I File for Social Security Disability in Minnesota?

- What Disability Program Should I Apply For?

- What Medical Conditions Qualify for Disability in Minnesota?

- Who Decides Whether I’m Disabled in Minnesota?

- How Do I Appeal a Denial of Benefits in Minnesota?

- How Much Does Minnesota Pay in Disability Benefits?

- Minnesota Vocational Rehabilitation Services (VRS)

- Do I Need a Minnesota Lawyer to Help With My Disability Claim?