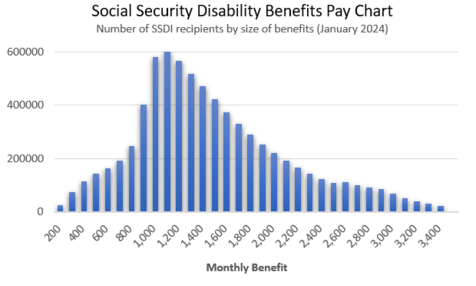

How much SSDI pays depends on your average lifetime earnings, but the maximum payment is $3,627. Here’s a chart showing how much your SSDI payment could be in 2023.

If you're eligible for Social Security Disability Insurance (SSDI) benefits, the amount you receive each month will be based on your average lifetime earnings before your disability began. Unlike veterans compensation, workers' comp, or Supplemental Security Income payments, SSDI isn't based on how severe your disability is or how much income you have—everything depends on those lifetime earnings.

As you can see from this disability payment chart, most SSDI recipients receive between $800 and about $1,500 per month. (Source: Social Security Administration DIsabled Worker Beneficiaries Chart, December 2023.) But if you're receiving disability payments from other sources, your payment may be reduced. (More on reduced payments below.)

How Much Disability Will I Get?

How much is SSDI? In 2024, the average SSDI payment for an individual is $1,537, but almost two-thirds of SSDI recipients receive less than that. And only 10% of SSDI recipients receive $2,000 per month or more.

If you have a family, your household SSDI income might be higher. (Minor children can get benefits, as can spouses who are taking care of minor children or who have reached retirement age.) The 2024 average Social Security benefit per month for an SSDI recipient who has a spouse and children is $2,720.

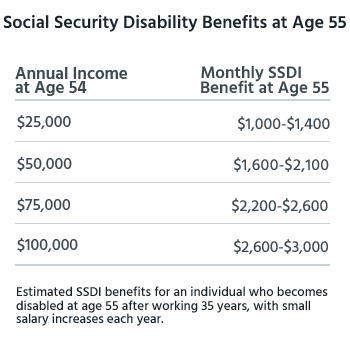

Because benefit amounts depend on lifetime earnings, there's a large range in how much Social Security pays. For instance, let's look at age 55, the most common age disabilities start. For 55-year-olds who have worked their entire lives, Social Security typically pays $1,000 to $2,800.

The benefits pay chart here shows you the ranges based on income at age 55.

Within those ranges, the amount you'll receive will depend on the following:

- your average income over 35 years (if you've worked that long)

- whether you paid self-employment taxes if you owned your own business or freelanced

- whether you worked in any jobs that didn't pay into the Social Security system (such as state or local government jobs), and

- whether you took any years off work for child-rearing or long-term illness.

What Is My Social Security Disability Benefit Amount?

The best place to find your exact SSDI benefit amount is your Social Security Statement. You can find your statement online at www.ssa.gov/myaccount. (If you're 60 or older, Social Security will send you a printed statement once a year if you don't set up an online account.)

If you don't receive benefits yet, your Social Security Statement will show you what your SSDI payment will be if you get approved for disability benefits this year. It also shows what your Social Security retirement benefit would be at ages 62, 67, and 70.

You can also check your entire covered earnings history on your Social Security Statement.

The SSA still has an online benefits calculator that you can use to get an estimate of your monthly benefits, but if you sign up for an account to see your new Social Security Statement, you won't need it.

You can also call your local Social Security office, and a field representative will be able to help you estimate what your benefits would be.

How Is SSDI Calculated?

The exact amount of money people get for SSDI each month is unique for every individual. The Social Security Administration (SSA) uses a complex weighted formula to calculate benefits for each person.

But the Social Security disability maximum monthly benefit is $3,822 in 2024.

Doing the math yourself to calculate your own benefit amount is difficult, but here's how the formula works. It helps to know how disability is calculated. (But there are easier ways to find out how much disability you'll get, which we cover in the next section.)

AIME. Social Security bases your retirement and disability benefits on the amount of income on which you've paid Social Security taxes—called "covered earnings." Your average covered earnings over the past 35 years are known as your "average indexed monthly earnings" (AIME).

Bend points. The SSDI formula uses fixed percentages of different amounts of income. These percentages, called "bend points," are adjusted each year. In 2024, here are the bend points and how they come together:

- 90% of the first $1,174 of your AIME

- plus 32% of your AIME from $1,174 to $7,078

- plus 15% of your AIME over $7,078.

PIA. Adding those three figures together gives the SSA your primary insurance amount (PIA). Your monthly SSDI benefit amount will be 100% of your PIA.

Can Other Income Reduce Your SSDI Payment?

Income from work won't reduce your SSDI payment, and any disability benefits you receive from a private long-term disability insurance policy won't affect your SSDI benefits. Nor will Supplemental Security Income or VA benefits impact your SSDI amount. But government-regulated disability benefits, such as workers' comp or temporary state disability benefits, can affect your SSDI benefits.

Here's how that works: If the amount in SSDI plus the amount from government-regulated disability benefits is more than 80% of the amount you earned before you became disabled, the SSDI or other benefits will be reduced.

The following types of government benefits could also lower your SSDI payment:

- workers' comp payments

- state short-term disability payments

- civil service disability benefits, and

- state or local government retirement benefits based on disability.

Can the Amount of Your SSDI Check Change?

Most years, your monthly SSDI payment will go up, thanks to Social Security's annual cost of living adjustment (COLA). You can find the annual COLA here.

Once you're eligible for Medicare benefits (two years after you become entitled to SSDI benefits), the cost of Medicare Part B will be taken directly out of your Social Security check. Most people will pay a premium of $174.70 for Part B in 2024, but the amount can be quite a bit higher for those with high income.

If you have low income, a Medicare Savings Program can pay your Part B premium.

Otherwise, your SSDI check won't change, unless you start collecting workers' comp or one of the government benefits mentioned above.

How Much in Social Security Back Pay Can You Get?

How much you'll receive in Social Security disability back payments depends on your SSDI monthly amount. And how many months of back payments you get is determined by your application date and your established date of onset (when your disability started). For instance, if you were disabled for 10 months before you were approved for benefits, you will get 10 months of back payments.

If you previously applied for disability benefits but didn't get them that time, your backpay might go back even further—to the original application date. Learn more about how SSDI backpay is calculated.

Average Social Security Disability Benefit Amount Per State

The chart below shows the average monthly SSDI payment in each state for people who can no longer work (benefit amounts for widows and adult children are not included).

In most states, the average payment hovers around $1,700, but in several outlier areas, the average amounts dip to around $1,600, and some of the Northeast states have average monthly payment amounts that climb close to $1,900.

Find the average benefit amount for your state below.

|

State |

Average Disability Payment Per Month |

|

Alabama |

1,702 |

|

Alaska |

1,803 |

|

Arizona |

1,767 |

|

Arkansas |

1,659 |

|

California |

1,649 |

|

Colorado |

1,780 |

|

Connecticut |

1,827 |

|

Delaware |

1,867 |

|

District of Columbia |

1,519 |

|

Florida |

1,717 |

|

Georgia |

1,688 |

|

Hawaii |

1,773 |

|

Idaho |

1,672 |

|

Illinois |

1,738 |

|

Indiana |

1,729 |

|

Iowa |

1,671 |

|

Kansas |

1,682 |

|

Kentucky |

1,689 |

|

Louisiana |

1,639 |

|

Maine |

1,646 |

|

Maryland |

1,833 |

|

Massachusetts |

1,834 |

|

Michigan |

1,776 |

|

Minnesota |

1,771 |

|

Mississippi |

1,634 |

|

Missouri |

1,686 |

|

Montana |

1,654 |

|

Nebraska |

1,643 |

|

Nevada |

1,765 |

|

New Hampshire |

1,817 |

|

New Jersey |

1,947 |

|

New Mexico |

1,627 |

|

New York |

1,809 |

|

North Carolina |

1,699 |

|

North Dakota |

1,675 |

|

Ohio |

1,665 |

|

Oklahoma |

1,654 |

|

Oregon |

1,691 |

|

Pennsylvania |

1,777 |

|

Rhode Island |

1,729 |

|

South Carolina |

1,686 |

|

South Dakota |

1,629 |

|

Tennessee |

1,679 |

|

Texas |

1,703 |

|

Utah |

1,733 |

|

Vermont |

1,665 |

|

Virginia |

1,748 |

|

Washington |

1,798 |

|

West Virginia |

1,736 |

|

Wisconsin |

1,742 |

|

Wyoming |

1,737 |

Source:

Annual Statistical Report on the Social Security Disability Insurance Program, 2022

Updated March 7, 2024

Talk to a Disability Lawyer

Need a lawyer? Start here.

How it Works

- Briefly tell us about your case

- Provide your contact information

- Choose attorneys to contact you

Get the Compensation You Deserve

Our experts have helped thousands like you get cash benefits.

How It Works

- Briefly tell us about your case

- Provide your contact information

- Choose attorneys to contact you