Social Security issues a technical denial of disability benefits when an applicant doesn’t meet the legal or financial requirements of SSDI or SSI.

When someone is denied Social Security disability benefits, it's usually for medical reasons—that is, the Social Security Administration (SSA) didn't find the applicant's medical condition was so severe that the person couldn't work.

But a significant number of disability applicants receive a "technical denial," meaning Social Security found the applicant ineligible for benefits for non-medical reasons (and the SSA didn't even review the medical evidence). According to Social Security, almost half of those who apply for Social Security disability insurance (SSDI) benefits and a quarter of Supplemental Security Income (SSI) applicants receive technical denials.

Here are some of the most common reasons you could receive a technical denial (also called a "non-medical review denial") after applying for SSDI or SSI disability benefits.

Situations That Always Result in a Technical Denial

There are many reasons Social Security denies SSDI and SSI claims before considering any medical evidence. But the two most common reasons for technical denials involve working too much and not staying in touch with Social Security.

Earning Too Much = Immediate Denial

To be eligible for SSDI and SSI disability benefits, your medical condition must prevent you from working, or at least from working so much that Social Security considers your work to be "substantial gainful activity" (SGA). If you earn more than the SGA limit, Social Security will deny your disability benefits without even looking at your medical evidence. The SGA limit in 2024 is $1,550 per month for both SSDI and SSI applicants.

Social Security Can't Find You

If Social Security tries to reach you after you file an application for disability and it can't contact you or find you, the agency will eventually deny your claim. So, it's critical that you give Social Security accurate contact information and that you notify the SSA if you move or your contact information changes.

Likewise, if Social Security requests additional information from you, you need to respond as soon as possible. Failure to do so could result in your claim being denied.

Technical Denials in SSDI Claims

To be eligible for Social Security disability insurance (SSDI) benefits, you need to be younger than full retirement age and have paid enough into the system. You pay into Social Security when you pay FICA taxes via payroll deductions or self-employment taxes (SECA taxes).

If you haven't paid enough Social Security taxes or haven't paid them recently enough, your SSDI claim will be denied on technical grounds.

Denied SSDI Because You Haven't Worked Long Enough

The most common reason Social Security issues technical denials of SSDI applications is because the applicant hasn't worked and paid into the system long enough to be covered under the program. Social Security uses a system of "work credits" to determine when you're covered.

You can earn up to four work credits per year. The number of years you need to have worked (and the number of work credits you need to have earned) depends on your age. The older you are, the more work credits you need to be eligible for SSDI benefits.

For example, if you're 50 years old, you need to have worked at least 7 years (and earned 28 work credits) at a job that pays into Social Security. But if you're 30, you need only have 8 work credits, which you can earn after working just 2 years. For more information, see our article on SSDI work credits.

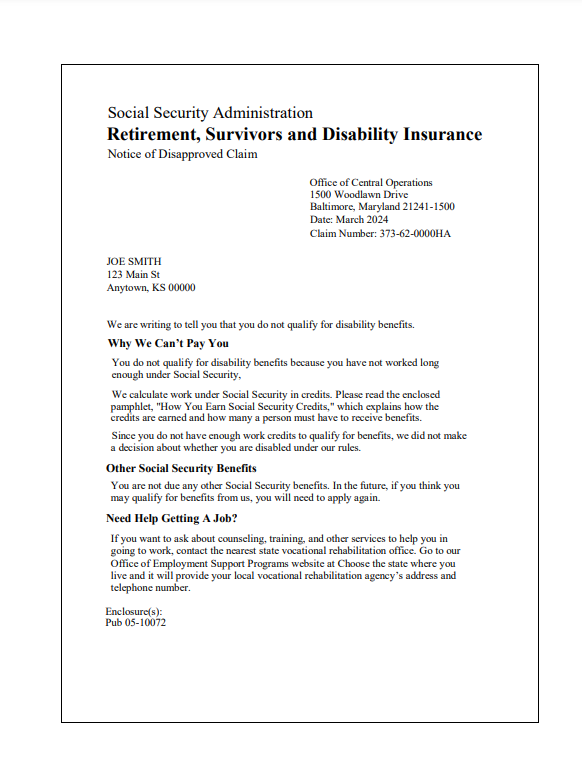

This sample technical denial letter is an example of what a technical denial from Social Security would look like if you don't have enough work credits. Click on the image to enlarge it.

Denied SSDI When You Haven't Worked Recently Enough

You might receive a technical denial if you haven't worked in recent years. SSDI is a type of disability insurance coverage that will lapse after a certain amount of time, if you stop paying FICA taxes into the system.

The date you're no longer covered by SSDI is called your "date last insured" (DLI). The exact requirement for how recently you need to have worked depends on your age when you become disabled.

For example, if you're 31 or older, you must have worked for 5 of the last 10 years to qualify for SSDI benefits. So, if you're over 31 and you worked your whole life but stopped working exactly 6 years ago, your date last insured would be exactly one year ago. And if you became disabled today, you wouldn't be eligible for SSDI.

If you can provide records that prove your disability existed before your DLI, you might be able to successfully appeal a technical denial (see below). For more information, see our article on the date last insured for SSDI.

Technical Denials in SSI Claims

Supplemental Security Income, or SSI, is a needs-based (low-income) disability benefit program with no past work or earnings requirements. But to be eligible for SSI benefits, you must not exceed strict income and asset limits. Most technical denials in SSI cases are due to applicants exceeding these financial limits.

Claim Denied Due to SSI Income Limit

To be eligible for SSI, you must earn less than the SGA limit and your household income must fall under the "federal benefit rate" (FBR)—the maximum monthly SSI benefit amount. For 2024, the FBR is $943 per month for individuals and $1,415 for couples. Fortunately, not every penny you or your spouse earns counts as income for SSI eligibility purposes. Learn more in our article on the SSI income limit.

Claim Denial When You're Over the SSI Asset Limit

You'll also receive a technical denial for being "over-resource" if Social Security determines that you (and your spouse) exceed the SSI asset limit. You can't qualify for SSI if you have more than $2,000 in assets ($3,000 for married couples), not counting your home and one vehicle. Learn more about what counts toward the SSI asset limit.

Other Reasons for a Non-Medical Review Denial

There are several other reasons Social Security might issue a technical denial of your claim. Some of those are based on your legal status in the United States.

Technical Denials Based on Citizenship/Immigration Status

SSDI and SSI disability benefits are available to U.S. citizens and certain eligible immigrants. But you must be able to prove your citizenship or legal immigration status. Learn more in our article on getting disability if you're not a U.S. citizen.

Even U.S. citizens and eligible immigrants can receive technical denials for SSDI or SSI if they move abroad or leave the United States for too long. For SSDI, this only applies to certain countries. Learn more in our article on how moving abroad affects disability benefits.

How Felony Conviction Affects Disability Eligibility

Although a felony conviction often won't affect your eligibility for SSDI or SSI, your status can (for example, if you're serving a prison sentence). You won't meet the non-medical requirements for Social Security disability if you're:

- fleeing prosecution or imprisonment for a felony

- currently in prison, in jail, or living in a state-operated halfway house after incarceration, or

- guilty of certain felonies.

Learn more about how a felony conviction affects your eligibility for Social Security.

When Age Causes a Social Security Denial

Although your age won't affect your SSI eligibility, Social Security will deny an SSDI application filed more than 12 months after you reach full retirement age or if your claim is based on a disability that started five months (or less) before full retirement age. SSDI's five-month waiting period means you wouldn't be eligible to receive disability benefits until after you were eligible for full retirement benefits.

Learn more in our article on applying for SSDI after retirement.

Technical Denials for Spouse and Dependent Benefits

Social Security dependent and survivors benefits are available for the families of disabled workers eligible for SSDI benefits, including the worker's:

- spouse (and sometimes ex-spouse)

- minor children (including step- and adopted children)

- disabled adult children, and

- dependent parents.

The non-medical criteria for these benefits vary depending on the type of benefit you're applying for. For example, if you apply for dependent benefits as a disabled adult child and you're married, Social Security may issue a technical denial. If you're applying for survivors benefits as a disabled spouse, but you're younger than 50 and not caring for your deceased spouse's children (under 16), Social Security will deny your claim based solely on your age.

Learn more about the technical eligibility requirements for dependent benefits in our article on SSDI family benefits.

Reasons Social Security Issues Technical Denials

Here's a helpful chart with the reasons why so many disability applications receive a non-medical review denial.

|

Reason Social Security Issues a Technical Denial |

Technical Denial for SSDI? |

Technical Denial for SSI? |

|

Your application is incomplete |

Yes |

Yes |

|

You're earning more than the SGA limit |

Yes |

Yes |

|

Social Security can't contact you |

Yes |

Yes |

|

You have ineligible citizenship or immigration status |

Yes |

Yes |

|

You haven't worked long enough |

Yes |

No |

|

You haven't worked recently enough |

Yes |

No |

|

Your family earns over the federal benefit rate (FBR) |

No |

Yes |

|

Your family has too many assets |

No |

Yes |

|

You fail to respond to a Social Security request |

Yes |

Yes |

|

You live outside the United States |

No |

Yes |

|

You live in a country where Social Security can't send benefits |

Yes |

Yes |

|

You're too close to retirement age |

Yes |

No |

Appealing a Technical Denial

Most technical denials can't be appealed. For instance, if you don't have the work credits to be eligible for SSDI or aren't old enough for disabled spouse's benefits, filing an appeal won't change this. However, in some cases, you can file an appeal, including when:

- Social Security made an error in evaluating your income or assets

- the technical denial was due to a paperwork error, or

- the denial is based on a missing document.

Social Security disability denials must be appealed within 60 days of receiving the denial letter. For more information, see our article on what to do if your disability benefits are denied.

Updated March 29, 2024

Talk to a Disability Lawyer

Need a lawyer? Start here.

How it Works

- Briefly tell us about your case

- Provide your contact information

- Choose attorneys to contact you

Get the Compensation You Deserve

Our experts have helped thousands like you get cash benefits.

How It Works

- Briefly tell us about your case

- Provide your contact information

- Choose attorneys to contact you